Choosing the right taxation method is a crucial financial decision for any business. The method you choose impacts not only your tax liability but also your accounting workload, compliance risks, and cash flow management. Among the various taxation methods, two prominent options often considered by businesses—especially small and medium enterprises (SMEs)—are real profit taxation and presumed profit taxation. Understanding the nuances of these systems can help business owners optimize taxation strategy and improve overall financial health.

Both real and presumed profit taxations follow distinct principles, applicability criteria, and regulatory guidelines. This article explores these two systems in detail, highlighting the pros and cons of each, and provides actionable insights, practical examples, and data to help businesses make an informed choice.

Understanding Real Profit Taxation

Real profit taxation (also known as actual profit taxation) is based on a company’s actual net income, calculated from its revenues minus all allowed expenses. This method requires detailed bookkeeping and financial reporting to accurately reflect the company’s profits.

Under real profit taxation, businesses calculate income tax based on the precise profit shown in financial statements. This process mandates maintaining comprehensive accounting records, tracking all revenues and costs, and often engaging professional accountants. It is generally preferred by larger or more complex businesses with robust accounting systems.

A practical example is a retail company that tracks all its sales, purchases, operating expenses, and salaries to determine taxable income. For instance, Company A reported revenues of $1,000,000 and total deductible expenses of $700,000, resulting in a net profit of $300,000. Taxes would then be calculated based on this accurate profit figure, ensuring the company pays taxes proportionate to its actual earnings.

Recent data from the Small Business Administration (SBA) indicates that businesses using real profit taxation often benefit from tax deductions that reduce their taxable income by an average of 15-25%, compared with presumed profit systems. This advantage is especially notable in industries with variable expenses, such as manufacturing or wholesale distribution.

Key Features of Presumed Profit Taxation

Presumed profit taxation simplifies tax calculation by assuming a fixed percentage of a business’s gross revenue as profit, regardless of actual expenses. This method reduces the complexity of accounting, as businesses do not need to itemize all expenses to determine taxable income.

This system is widely used by smaller companies, startups, and freelancers, as it alleviates the burden of intense bookkeeping and financial reporting. For example, under the presumed profit method, a consulting firm with gross revenue of $200,000 might pay income tax on a presumed profit rate of 32%, which equals $64,000. This method is easy to administer and can be highly advantageous for businesses with low operational costs.

A survey published by the Tax Policy Center in 2023 reported that 60% of micro and small businesses opt for presumed profit taxation due to its simplicity and predictability, even though this sometimes results in a higher effective tax rate when expenses are significant.

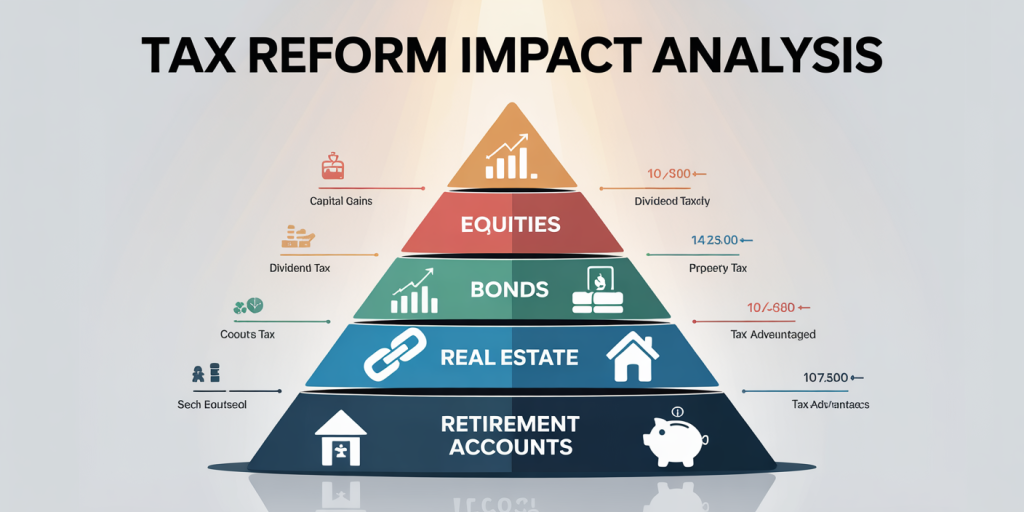

Comparative Analysis: Pros and Cons

| Aspect | Real Profit Taxation | Presumed Profit Taxation |

|---|---|---|

| Calculation Basis | Actual net profit (Revenue – Expenses) | Fixed percentage of gross revenue |

| Accounting Requirements | Detailed bookkeeping and accounting | Simplified records, minimal documentation |

| Tax Burden | Reflects actual profitability | May lead to higher tax if expenses are high |

| Complexity | More complex, time-consuming | Easier and faster to comply with |

| Applicability | Larger businesses, firms with variable expenses | Small businesses, low-expense companies |

| Risk of Audit | Lower if proper records maintained | Potentially higher if revenue underreported |

| Cash Flow | Potentially better aligned with actual profits | Tax payable may not reflect real earnings |

One practical case study involves two Brazilian companies under different taxation models. Company B, a real profit tax payer, reported net profits after accounting for high operational expenses and thus paid income tax on $100,000. Meanwhile, Company C, with similar gross revenue but under presumed profit regime, paid income tax on a presumed profit of $250,000, reflecting a significant disadvantage in taking the simpler route.

When Is Real Profit Taxation More Advantageous?

For businesses with variable or high expenses, real profit taxation generally presents an opportunity to reduce taxable income by accounting for those costs. Industries such as construction, technology services, or manufacturing frequently encounter fluctuating costs related to labor, equipment, raw materials, and overheads.

Consider a technology startup investing heavily in R&D. Its gross revenue might be modest, but expenses for product development and marketing are substantial. Under real profit taxation, the startup can deduct such costs, thereby minimizing taxable base. Data from a 2022 IRS report showed startups using real profit taxation saved an average of 18% in income tax when compared to presumed profit models.

Furthermore, real profit taxation enables businesses to utilize tax incentives, depreciation, and amortization policies, which can significantly reduce the taxable amount. Companies with assets such as machinery or vehicles benefit from depreciation deductions that cannot be claimed under presumed profit taxation.

Real profit taxation also aligns the tax payment schedule closely with actual profitability, thereby preventing overpayment during loss-making periods. A classic example is a construction company facing seasonality, which experiences profits only in certain quarters but incurs fixed costs year-round.

Situations Favoring Presumed Profit Taxation

Presumed profit taxation shines in simplicity and predictability. Businesses on tight budgets or without access to sophisticated accounting services often choose this system to reduce administrative costs.

Small retailers, individual freelancers, and service providers with stable, low expenses benefit from presumed profit’s fixed rates. For example, a hair salon with $100,000 annual revenue and minimal operating costs might find presumed profit taxation advantageous, as it avoids the complexities and consultancy fees related to maintaining real profit records.

Additionally, presumed profit taxation offers predictability in tax cash flow. Since taxation is based on gross revenue, companies can forecast their liabilities easily. This predictability aids in better financial planning for entrepreneurs with limited accounting expertise.

A study by the National Federation of Independent Businesses (NFIB) highlights that nearly 70% of sole proprietors choose presumed profit taxation to avoid administrative burdens despite a potentially higher tax bill. This strategy suits businesses that prioritize simplicity and steady financial routines over tax optimization.

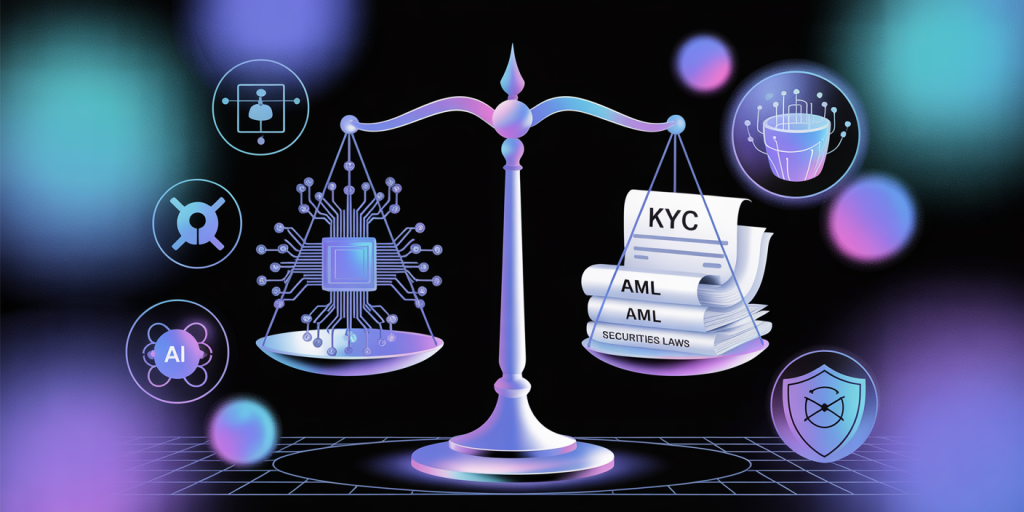

Legal and Regulatory Considerations

Both real and presumed profit taxations operate under specific regulatory frameworks that differ by jurisdiction. For example, in Brazil, companies with gross revenue up to R$78 million can opt for presumed profit taxation, whereas larger firms must use real profit taxation.

The U.S. employs a different approach where business type and revenue size affect taxable income calculations but do not explicitly categorize taxation this way. Nevertheless, the principle of taxing actual profits after accounting for expenses broadly applies, akin to real profit taxation.

It is essential to be aware of regulatory requirements for each system to avoid penalties. For instance, failure to maintain proper accounting under real profit regimes can result in audit risks and fines. Contrarily, firms under presumed profit taxation must accurately report gross revenues to prevent discrepancies leading to tax evasion accusations.

Future Perspectives and Digital Innovations in Taxation

As tax authorities worldwide embrace digitalization, both real and presumed profit taxation systems are evolving. Real-time reporting platforms, automated bookkeeping software, and AI-powered analytics help businesses manage the complexity of real profit taxation more efficiently.

Data analytics tools now allow firms to forecast tax liabilities dynamically, optimize expense tracking, and ensure compliance with evolving regulations. For example, cloud-based accounting solutions reduce errors and provide instant reports that support real profit tax filing.

Moreover, some countries are experimenting with hybrid tax regimes combining elements of both methods to adapt to varied business models. Digital invoicing and blockchain technology are further streamlining tax audits, reducing evasion, and enhancing transparency regardless of the chosen system.

Looking ahead, smaller businesses may increasingly leverage technology to adopt real profit taxation without excessive administrative burdens, optimizing tax payments according to true profitability. Meanwhile, tax authorities aim to balance simplicity with fairness, possibly adjusting presumed profit rates or thresholds based on real-time data trends and economic indicators.

Making the Right Choice

Choosing between real and presumed profit taxation depends on your business size, industry, expense structure, and capacity for financial management. Generally, real profit taxation is best suited for companies with significant or variable costs seeking tax efficiency and deduction opportunities. Conversely, presumed profit taxation is advantageous for simpler operations prioritizing ease of compliance and predictable tax liabilities.

Consulting with a tax advisor to analyze your specific financial statements, operational costs, and growth trajectory is critical. Armed with accurate data and expert guidance, you can select a taxation method that minimizes liabilities while ensuring regulatory compliance and supporting sustainable business development.

As tax laws and technologies evolve, staying informed and adaptable will be key for businesses aiming to optimize their taxation strategies effectively.