In recent years, Environmental, Social, and Governance (ESG) criteria have become a crucial standard for responsible investment and corporate accountability. However, as the world confronts increasingly complex ecological and social challenges, the limitations of ESG frameworks are becoming apparent. The emerging field of Regenerative Finance (ReFi) promises to transcend traditional ESG approaches by fundamentally reimagining how capital interacts with economic and natural systems. This article explores why regenerative finance represents the next evolution beyond ESG, offering innovative pathways for sustainable and equitable growth.

Evolving Beyond ESG: The Need for Regenerative Finance

ESG investing has rapidly gained traction among institutional and retail investors alike, with global ESG assets predicted to surpass $53 trillion by 2025, representing more than a third of global assets under management (Morningstar, 2023). ESG frameworks guide companies and investors to mitigate risks related to environmental degradation, social inequality, and governance failures. Despite this progress, criticisms persist that ESG often maintains a risk-management mindset rather than fostering systemic change.

For example, a 2022 report by the U.S. Securities and Exchange Commission (SEC) highlighted significant inconsistency and greenwashing in ESG disclosures, limiting the framework’s true impact on sustainability outcomes. Furthermore, ESG initiatives frequently focus on reducing harm rather than restoring or regenerating resources. This is where regenerative finance steps in: to drive investments that not only avoid harm but actively replenish natural ecosystems and social capital.

Defining Regenerative Finance: A Paradigm Shift

Regenerative finance is a system of investing and capital allocation designed to create positive, self-sustaining effects on both environmental and social systems. Unlike ESG, which often emphasizes compliance and incremental improvements, regenerative finance encourages investments that restore ecosystems, rebuild communities, and enhance long-term resilience.

At its core, regenerative finance integrates principles from ecological economics, biomimicry, and social justice frameworks. For instance, ReFi projects often channel funding into regenerative agriculture practices that improve soil health, increase biodiversity, and sequester carbon. A practical example is the Terra Genesis International project, which combines investment with regenerative land management to restore degraded landscapes while providing viable financial returns.

This approach contrasts sharply with traditional fossil fuel divestments adopted by many ESG funds. Instead of simply withdrawing capital from polluting industries, regenerative finance fosters the creation of new economic models that are circular, restorative, and equitable. Thus, regenerative finance is about reshaping the economy to function more like a living system, emphasizing net positive outputs rather than neutral or minimally negative impacts.

Core Principles and Mechanisms of Regenerative Finance

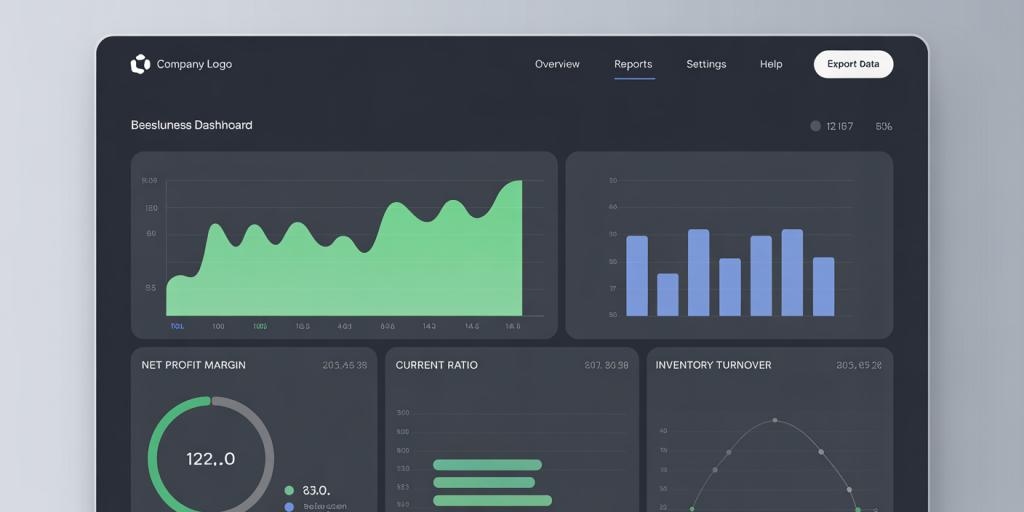

Regenerative finance operates under several guiding principles, including systemic thinking, mutual benefit, and long-term orientation. Investments are evaluated not just on financial return but on their ability to generate regenerative effects across multiple dimensions—ecological health, social well-being, and economic vitality.

One key mechanism in ReFi is the use of outcomes-based financing models such as impact bonds, carbon markets with community benefits, and decentralized finance (DeFi) platforms enabling greater transparency and stakeholder participation. For example, the Communities Regenerate fund in Australia uses social impact bonds to finance indigenous-led land restoration, ensuring capital flows directly contribute to community empowerment while delivering verifiable environmental outcomes.

Another innovative mechanism is regenerative cryptocurrencies and tokens that reward positive environmental actions. The Klima DAO, a decentralized autonomous organization, uses blockchain to incentivize carbon offsetting, creating a transparent and participatory carbon marketplace that could revolutionize how we finance climate action.

| Feature | ESG Finance | Regenerative Finance |

|---|---|---|

| Primary Focus | Risk mitigation and compliance | Positive regeneration and restoration |

| Investment Time Horizon | Short to medium term | Long-term, systems-wide |

| Outcome Measurement | Disclosure and scoring | Multi-dimensional, outcome-based |

| Community Involvement | Limited, often top-down | Participatory, inclusive |

| Innovation Mechanisms | Traditional finance instruments | Impact bonds, DeFi, tokenization |

| Nature of Impact | Avoid harm, improve transparency | Replenish resources, systemic change |

Practical Examples Illustrating the Shift to Regenerative Finance

Several real-world cases highlight how regenerative finance is gaining momentum. The Blue Forest Conservation project in California exemplifies how investing in forest restoration can mitigate wildfire risks, improve watershed health, and deliver local economic benefits. The investment structure includes green bonds backed by sustainable timber harvests and ecosystem service payments, aligning financial incentives with ecological regeneration.

In the agricultural sector, companies like Patagonia Provisions invest in regenerative farming methods, supporting soil restoration while scaling markets for sustainable food products. This approach fosters resilient food systems, enhances biodiversity, and builds closer connections between producers and consumers—outcomes far beyond standard ESG scoring.

Another case is the Green New Deal proposals coupled with financing models targeting equitable infrastructure and renewable energy deployment. These strategies focus explicitly on creating systemic regenerative benefits by closing social equity gaps and restoring environmental health simultaneously. For instance, the New York State Environmental Bond Act, passed in 2022, allocates over $3 billion to projects that incorporate regenerative practices, including urban forestry and wetland restoration, alongside community engagement and job creation.

How Regenerative Finance Addresses the Gaps Left by ESG

While ESG metrics often rely on static indicators such as emissions intensity or labor policies, regenerative finance pushes toward dynamic, adaptive approaches that recognize the complexity of socio-ecological systems. This move from static reporting to outcome-oriented strategies is critical, given the nonlinear feedback loops inherent in climate and social challenges.

Moreover, ESG scores can mask underlying systemic issues if companies superficially comply with standards without shifting their actual operations or business models. Regenerative finance aims to embed transformation at the roots of economic activity by creating incentives for circular value chains, restorative supply ecosystems, and community resilience.

The incorporation of technology further distinguishes regenerative finance. Distributed ledger technologies enable transparency and trust in complex regenerative projects, allowing stakeholders to verify impact and participate in governance. This participatory finance model contrasts with traditional ESG frameworks, which tend to keep accountability confined to corporate and regulatory entities.

Future Perspectives: Scaling Regenerative Finance for Global Impact

Looking ahead, the scale and scope of regenerative finance are poised for significant expansion. According to a 2023 report by Deloitte, global impact investments, including regenerative projects, are expected to grow at a compound annual growth rate (CAGR) of over 15% through 2030. This growth is driven by escalating climate risks, investor demand for measurable impact, and advances in financial technology.

One promising trend is the convergence of regenerative finance with the burgeoning net-zero transition. Governments and multinational corporations are increasingly exploring investments that not only reduce carbon footprints but regenerate natural capital, thus achieving climate mitigation and adaptation simultaneously. Programs like the EU’s Green Deal and the UN’s Decade on Ecosystem Restoration offer frameworks to embed regenerative finance at policy and market levels.

Nevertheless, scaling ReFi requires addressing systemic barriers such as regulatory uncertainty, lack of standardized outcome metrics, and capital allocation biases favoring short-term profits. International collaboration and multi-stakeholder partnerships will be essential to establish robust impact standards, democratize access to capital, and foster innovation in financial instruments.

Ultimately, regenerative finance agrees with tenets from indigenous knowledge systems emphasizing harmony with nature and community stewardship. By incorporating these paradigms into mainstream finance, regenerative finance could redefine capitalism’s purpose—from merely generating profit to fostering flourishing ecosystems and societies.

—

In summary, regenerative finance presents an evolved framework that surpasses traditional ESG boundaries by focusing on restoration, systemic health, and equitable participation. As investors, policymakers, and communities worldwide face escalating environmental and social challenges, embracing regenerative finance can unlock new potentials for resilient economies and thriving planetary ecosystems. This next step beyond ESG is not only urgent but necessary for a truly sustainable and just future.