Relocating to a new city or country is an exciting adventure, filled with opportunities for personal growth, career advancement, and cultural enrichment. However, beneath the surface of this enthusiasm lies a critical aspect that requires thorough planning — financial preparedness. Moving is rarely just a change of address; it involves a significant shift in budgeting, expenses, and financial management. To avoid unexpected setbacks, it is vital to understand what financial factors must be evaluated before making such a monumental decision.

Deciding whether to move domestically or internationally brings distinct financial challenges and opportunities. According to a 2023 survey by Pew Research Center, approximately 15 million Americans relocate each year, with about one-third moving across state lines. International migration is also on the rise, with the UN estimating 281 million international migrants worldwide in 2020. Whether your relocation is across the street or across continents, being financially equipped can be the difference between a smooth transition and a stressful ordeal.

Estimating Total Moving Costs: Beyond the Basics

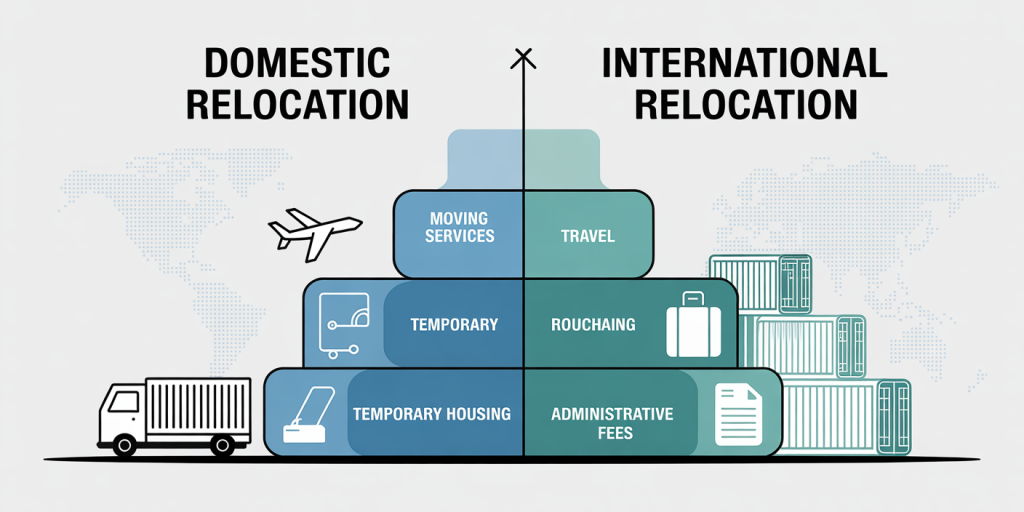

Moving costs are often underestimated, primarily because many factors come into play beyond just transportation and housing deposits. Typically, expenses include hiring movers, travel costs, temporary accommodation, administrative fees, and sometimes, unexpected charges such as customs duties when moving internationally.

For example, domestic moves in the United States can range broadly, with an average cost of $4,300 for a local move and upwards of $12,000 for a cross-country relocation (according to U-Haul’s 2023 data). In contrast, international moves can cost anywhere from $5,000 to over $20,000 depending on distance, weight of shipments, and service providers.

Consider the case of Anna, a software engineer moving from New York City to Berlin. Besides airfare, she had to budget for upfront visa processing fees, international movers, and setting up new utilities, which doubled her initial moving budget. Only after meticulous cost estimation was she adequately prepared for her relocation.

| Expense Category | Domestic Move (USD) | International Move (USD) |

|---|---|---|

| Moving Services | $2,000 – $10,000 | $5,000 – $15,000 |

| Travel (Flights) | $100 – $500 | $700 – $1,500 |

| Temporary Housing | $500 – $2,500 | $1,000 – $5,000 |

| Administrative Fees | $50 – $500 | $200 – $2,000 |

| Miscellaneous | $200 – $1,000 | $500 – $3,000 |

A comprehensive budget plan for moving should include these categories with a contingency fund of at least 10-15% to cover unforeseen expenses.

Understanding the Cost of Living Differences

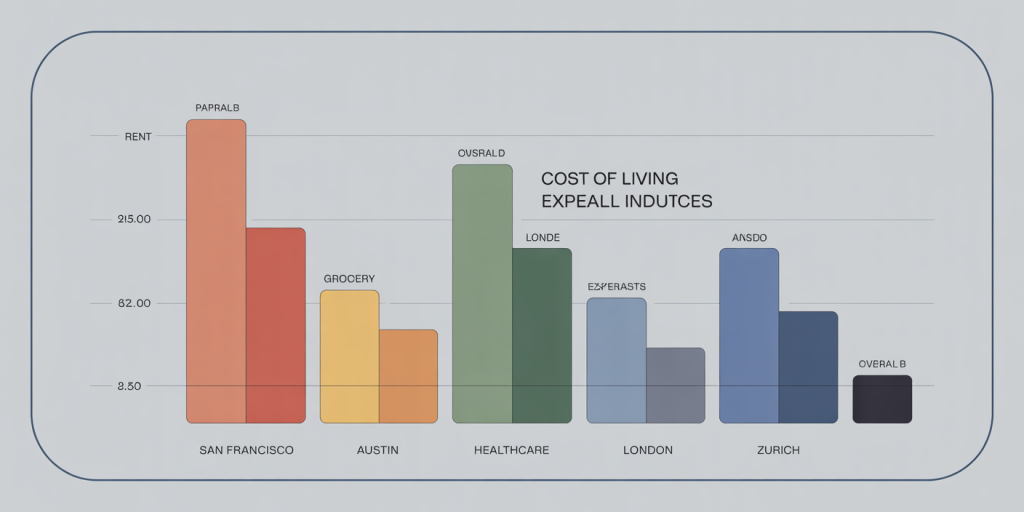

One of the most significant financial considerations when moving to a new city or country is how the cost of living compares to your current location. Cost of living encompasses housing, food, healthcare, transportation, education, and entertainment expenses that directly impact your disposable income and quality of life.

For instance, moving from a city like San Francisco to Austin, Texas, will mean a substantial decrease in housing costs. According to Numbeo’s 2024 data, San Francisco’s average rent for a one-bedroom apartment is approximately $3,200 per month, whereas in Austin, it is around $1,800. This difference could free up a significant portion of your income, allowing for savings or increased spending in other areas.

Conversely, an international example would be relocating from London, UK, to Zurich, Switzerland. Zurich ranks as one of the most expensive cities in the world, with a cost-of-living index over 130 (where New York is 100), while London is slightly less expensive. Expats may face higher grocery, transportation, and healthcare costs, emphasizing the importance of detailed research.

Comparison Table: Cost of Living Indices (Numbeo 2024)

| City | Cost of Living Index | Rent Index | Grocery Index | Healthcare Index |

|---|---|---|---|---|

| San Francisco | 120.5 | 151.3 | 112.4 | 105.6 |

| Austin | 85.6 | 90.4 | 80.7 | 83.4 |

| London | 95.3 | 103.7 | 87.9 | 90.1 |

| Zurich | 132.4 | 160.2 | 123.5 | 115.0 |

Individuals considering relocation should create a detailed monthly budget based on these indices to anticipate additional monthly costs or savings adequately.

Income Adjustments and Tax Implications

A crucial financial factor that individuals often overlook is the impact of relocation on income levels and taxation. Your salary offer might differ significantly depending on the city or country, and local tax regulations may affect your net income.

In the United States, moving from a low-tax state like Florida to higher-tax California can result in a higher tax burden, effectively reducing budgeting flexibility. California’s state income tax rates range from 1% to 13.3%, whereas Florida has no state income tax. One must factor in these considerations when negotiating salaries or employment contracts.

Internationally, expatriates face even more complex tax scenarios. For example, U.S. citizens living abroad must navigate U.S. federal taxes, foreign earned income exclusions, and possibly double taxation agreements. Countries like the UAE impose zero personal income tax, making it a lucrative relocation option, but the cost of living is comparatively high, necessitating a nuanced assessment.

The case of Miguel, who relocated from Madrid, Spain, to Toronto, Canada, exemplifies the importance of understanding tax regimes. While his gross salary increased by 15%, the combined federal and provincial tax rates in Ontario cut deeply into his take-home pay. Miguel had to adjust his personal budget to accommodate these changes.

Key Tax Considerations Before Moving: Understand state or country-specific tax rates. Check if your new location has treaties to avoid double taxation. Factor in social security, healthcare, and pension contributions. Consult tax professionals if planning an international move.

Healthcare and Insurance Costs

Healthcare expenses are a vital element that dramatically varies by location and can significantly impact your financial planning. The availability, quality, and cost of healthcare services play a deciding role, especially for families or individuals with existing medical conditions.

In the United States, health insurance costs can range from a few hundred to over a thousand dollars per month based on coverage. Moving to a new state may require changing providers or plans, potentially increasing monthly expenses. According to the Kaiser Family Foundation, the average employer-sponsored family health insurance premium was $23,000 annually in 2023.

Conversely, many European countries offer universal healthcare, which can reduce out-of-pocket costs substantially. For instance, moving from the U.S. to Sweden means healthcare costs will be largely covered by taxes, although private insurance might still be necessary for supplemental coverage.

Another important aspect is renters’ or homeowners’ insurance, which can differ depending on local laws and risk assessments (crime rates, natural disasters, etc.). For example, moving from a low-risk area like Dallas to a hurricane-prone city such as Miami will require factoring in additional insurance premiums.

Housing Market Dynamics and Deposit Requirements

Securing housing is often the largest financial hurdle when moving. Understanding local real estate markets, rental yields, and deposit policies is essential to avoid budget shocks.

In competitive cities like London or New York, initial rental deposits can be equivalent to one to three months’ rent, often required upfront. Some countries require guarantors or proof of income, which may entail additional costs such as agency fees or legal charges.

Homebuyers must also consider differing mortgage qualification criteria. For example, international buyers in Canada often face stricter credit checks and higher down payment requirements (usually 20-35%). Additionally, foreign buyers may be subject to property transfer taxes or foreign buyer levies that can add thousands of dollars to the cost.

Consider the following example comparing rental deposits:

| City | Average Monthly Rent (USD) | Typical Deposit Requirement | Additional Fees |

|---|---|---|---|

| New York | $3,000 | 1-2 months’ rent | Broker fee 12-15% of annual rent |

| Berlin | $1,200 | 2 months’ rent | None or minimal |

| Sydney | $2,200 | 4 weeks’ rent | Application fees |

Being aware of housing market dynamics allows for better negotiation and financial forecasting.

Future Perspectives: Planning for Financial Stability Post-Move

Financial considerations don’t end once you arrive in your new city or country; they evolve continuously. Long-term financial stability depends on adapting to new financial ecosystems and future planning.

Career growth opportunities and local economic conditions influence income trajectories. For instance, cities with booming tech industries (like Seattle or Bangalore) may offer greater earning promises but also higher living costs. Monitoring job market trends will help later recalibrations in your financial goals.

Furthermore, consider retirement planning and social security systems which vastly differ worldwide. Certain countries offer robust pension systems, while others require individuals to boost personal savings. Investing in local saving schemes or international financial instruments can offer a diversified security net.

Lastly, building a local credit history is critical for future loans, mortgages, or business ventures. Opening local bank accounts and maintaining steady financial behavior can take months to years but are essential for financial assimilation.

Moving forward, individuals should: Regularly review and adjust budgets based on actual expenses. Stay informed about local financial laws and benefits. Seek advice from financial planners specializing in expatriate or intercity moves. Utilize digital apps and tools to monitor spending and saving efficiently.

—

Relocating to a new city or country requires comprehensive financial due diligence. From estimating initial moving costs to understanding cost of living differences, tax implications, healthcare, and housing markets, each facet plays a vital role in shaping your financial viability. With proper forecasting, realistic budgeting, and ongoing adjustments, you can make your move a powerful catalyst for financial and personal success.

Deixe um comentário