Decentralized Finance, or DeFi, has emerged as a revolutionary force in the financial industry, promising to redefine how people access and interact with financial services. Built on blockchain technology, DeFi eliminates intermediaries such as banks and brokers, enabling peer-to-peer transactions and automated protocols through smart contracts. As of 2024, the total value locked (TVL) in DeFi protocols exceeded $80 billion, underscoring its growing significance in the global economy. But is DeFi truly the future of finance, or just a passing trend? This article explores the foundations, practical applications, advantages, risks, and future perspectives of DeFi to assess its potential impact on traditional finance.

The Rise of Decentralized Finance: Foundations and Functionality

DeFi platforms operate primarily on blockchain networks such as Ethereum, Binance Smart Chain, and Solana, which allow users to engage in financial transactions without relying on centralized authorities. The core mechanism behind DeFi is smart contracts, self-executing contracts with terms directly written into code. These contracts facilitate everything from lending and borrowing to trading and insurance, all in a decentralized manner.

For instance, platforms like Aave and Compound allow users to lend their crypto assets in exchange for interest or borrow funds by collateralizing their holdings. These protocols automatically adjust interest rates based on supply and demand using algorithms. Unlike traditional savings accounts where banks control interests and loan approvals, DeFi democratizes access and offers higher yields under transparent terms.

Moreover, decentralized exchanges (DEXs) like Uniswap and SushiSwap enable users to swap tokens without intermediaries, contrasting sharply with centralized exchanges such as Coinbase or Binance. Liquidity pools replace order books, and users providing liquidity earn fees, promoting a more open and accessible market structure.

The accessibility of DeFi platforms worldwide also illustrates its transformative capability. While millions remain unbanked or underbanked, particularly in developing countries, DeFi provides an alternative channel to financial services without geographic restrictions or extensive documentation requirements.

Practical Use Cases and Real-World Impact

One of the hallmark successes of DeFi is its role in enabling financial inclusion. For example, in regions like Sub-Saharan Africa and Southeast Asia, people with limited access to traditional banks can use DeFi protocols on smartphones to save money, obtain loans, or purchase insurance. Platforms like Celo focus explicitly on mobile-friendly DeFi solutions tailored for emerging markets, taking advantage of stablecoins pegged to local currencies to reduce volatility and protect users’ funds.

Another practical case is yield farming, which allows investors to earn returns by contributing to liquidity pools. In 2020, the DeFi platform Yearn Finance popularized this concept by aggregating multiple lending protocols, thereby optimizing users’ yields without requiring deep technical knowledge. This innovation not only showcased DeFi’s capacity for financial creativity but also attracted billions of dollars worth of assets.

Besides investment and lending, decentralized insurance is gaining traction. Nexus Mutual provides smart-contract-based insurance against risks such as smart contract failures and exchange hacks. This model increases transparency, reduces overhead costs, and offers more tailored insurance products compared to conventional providers.

Furthermore, institutional interest in DeFi is rising. Major financial entities such as Goldman Sachs and JPMorgan are exploring blockchain and DeFi integration for clearing and settlement processes, demonstrating the sector’s potential to improve efficiency and reduce bureaucracy in traditional finance.

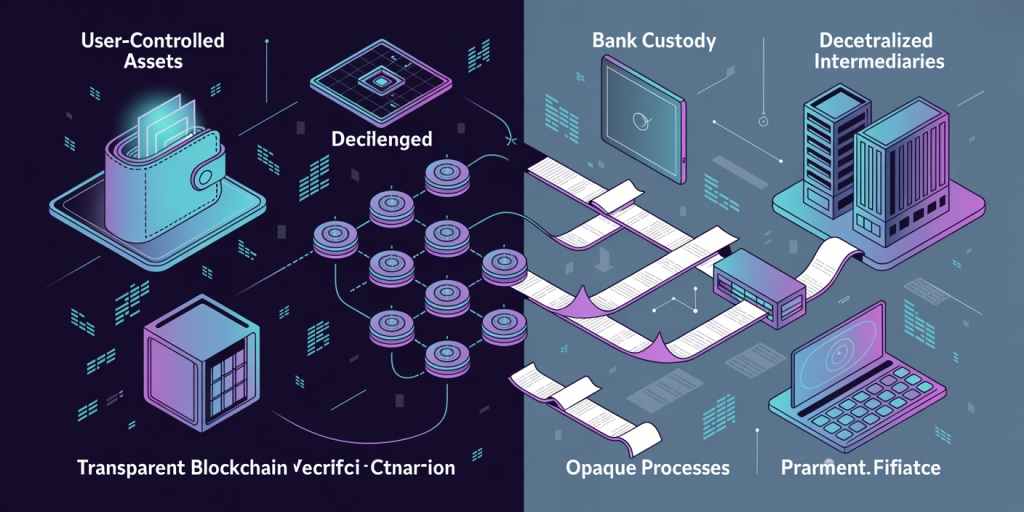

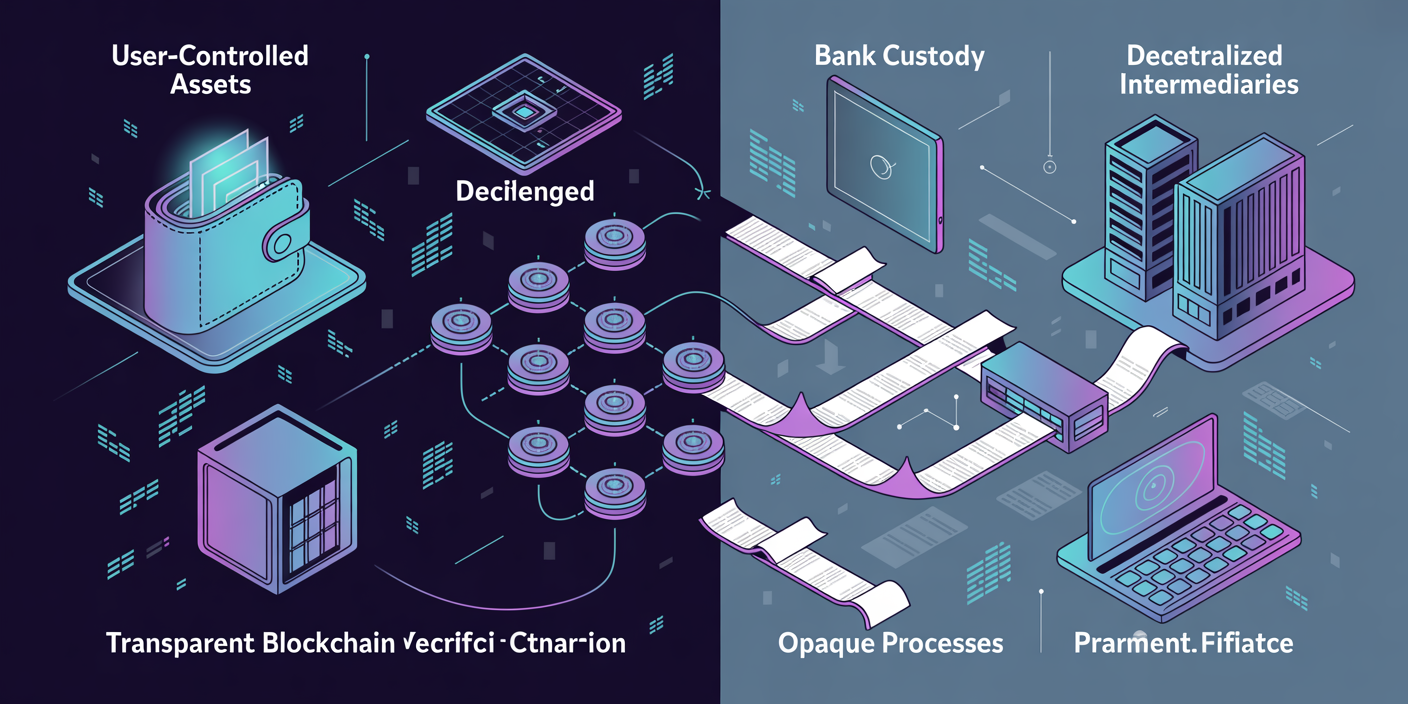

Comparing DeFi and Traditional Finance

| Feature | Decentralized Finance (DeFi) | Traditional Finance (TradFi) |

|---|---|---|

| Custody | Users control their own assets | Assets held by banks or brokers |

| Intermediaries | No intermediaries; peer-to-peer | Multiple intermediaries involved |

| Accessibility | Anyone with internet access | Limited by geography and regulations |

| Transparency | Open-source and blockchain-verified | Limited transparency, opaque processes |

| Transaction Speed | Minutes or seconds (varies by network) | Hours to days, depending on institution |

| Fees | Generally lower, protocol-driven | Typically higher, includes service fees |

| Regulation | Emerging and fragmented | Heavily regulated and standardized |

| Risk | Smart contract vulnerabilities | Institutional risk, fraud, and defaults |

This comparative table illustrates that while DeFi offers innovative features such as control over assets and enhanced transparency, it also presents novel risks not typically found in traditional finance. The absence of intermediaries reduces fees and increases inclusivity but shifts trust toward code and protocol security.

Advantages and Challenges of DeFi Adoption

The democratization of financial services is arguably DeFi’s most compelling advantage. By removing gatekeepers, users gain financial sovereignty—controlling their assets without reliance on third parties. Additionally, smart contracts enable automation, reducing transaction times and operational costs. DeFi’s composability allows developers to build interoperable applications, accelerating innovation.

Furthermore, open access and borderless transactions encourage global participation. For example, stablecoins like USDC and DAI provide price stability and act as mediums of exchange on DeFi platforms, complementing volatile cryptocurrencies. The ability to access microloans or instant swaps benefits individuals and small businesses alike.

However, the DeFi ecosystem faces significant challenges. Security remains paramount, as bugs in smart contracts can lead to millions lost in hacks or exploits. The notorious 2021 Poly Network hack, involving a theft of over $600 million (later partially recovered), highlighted the vulnerabilities inherent in complex DeFi protocols.

Regulatory uncertainty also clouds the industry’s future. Governments worldwide are grappling with how to classify and oversee DeFi products, balancing innovation with consumer protection and anti-money laundering efforts. Without clear frameworks, institutions may hesitate to fully engage, potentially limiting mainstream adoption.

User experience is another barrier. While DeFi apps have made progress in UI design, the technical knowledge required to interact securely with wallets, keys, and transaction fees remains a hurdle for average users accustomed to the simplicity of mobile banking.

Real Data and Growth Metrics in DeFi

The explosive growth of DeFi reflects its expanding influence. According to DeFi Llama, the total value locked in DeFi protocols grew from under $1 billion in early 2019 to a peak exceeding $150 billion in late 2021. Although this figure has fluctuated due to market corrections, the $80 billion TVL in mid-2024 indicates steady resilience.

Ethereum remains the dominant platform with over 60% of DeFi projects running on its network. However, Layer 2 solutions like Arbitrum and Optimism, plus rival blockchains like Solana and Avalanche, are attracting developers aiming for faster, cheaper transactions.

User adoption statistics offer additional insights. A report by ConsenSys indicated that DeFi users doubled in 2023, reaching over 5 million monthly active users globally. As awareness spreads and infrastructure improves, these numbers are expected to grow.

Commercial partnerships also signal maturity. In 2023, payment processors integrated stablecoin DeFi protocols to enable instant cross-border settlements, reducing fees by up to 70% compared to conventional systems like SWIFT.

Looking Ahead: The Future of Finance through the Lens of DeFi

The trajectory of DeFi suggests it will continue reshaping finance but likely in coexistence with traditional systems rather than outright replacement. Hybrid models combining centralized oversight with decentralized protocols are emerging, aiming to balance innovation with trust and regulatory compliance.

Advancements in blockchain scalability and interoperability will be critical drivers. Projects such as Ethereum 2.0 and cross-chain bridges will enhance transaction speeds and enable seamless asset transfers between different ecosystems, fostering a more integrated financial landscape.

Artificial intelligence and decentralized oracles (data sources) will enhance risk assessment and real-time decision-making in lending, insurance, and asset management DeFi platforms. This can improve both user experience and system security.

Regulatory clarity, though challenging, is anticipated to improve, with regional frameworks designed specifically for blockchain and DeFi products. This could unlock institutional investments and broader consumer participation by providing legal certainty.

Education and UX improvements remain essential to mainstream adoption. Initiatives focusing on simplifying wallet management and explaining risks will empower wider demographics, including retirees and less tech-savvy individuals, to engage safely with DeFi.

In essence, DeFi heralds a future in which finance is more inclusive, efficient, and transparent. Its ongoing evolution, combined with collaboration between innovators and regulators, will determine whether it becomes an integral pillar of the global financial system or remains a high-growth niche. Either way, DeFi is undeniably transforming the foundations of finance as we know it.

Deixe um comentário