In an era marked by escalating environmental concerns and urgent climate action, green bonds have emerged as a vital financial tool to channel investments toward sustainable projects. Green bonds enable governments, corporations, and financial institutions to raise capital dedicated exclusively to environmental initiatives that mitigate climate change, promote renewable energy, and support eco-friendly infrastructure. As the market for green bonds expands, their significance in fostering sustainable development continues to grow, underscoring their role in financing the transition toward a low-carbon economy.

The concept of green bonds was pioneered in 2007 by the European Investment Bank, followed shortly by the World Bank, which issued the first labeled green bonds with the explicit aim of funding climate and environmental projects. Since then, the green bond market has experienced exponential growth, surpassing $500 billion in annual issuance by 2023, reflecting both increasing investor interest and global commitments to sustainability goals such as the Paris Agreement. This article explores the dynamics of green bonds, their impact, challenges, and future outlook as key instruments for funding sustainability.

Defining Green Bonds and Their Impact

Green bonds are fixed-income securities specifically earmarked for raising funds to finance or refinance projects with positive environmental benefits. Eligible projects typically include renewable energy installations, energy efficiency improvements, pollution prevention, sustainable agriculture, and clean transportation. Unlike traditional bonds, green bonds are distinguished by their commitment to environmental objectives, often verified through third-party certifications or adherence to frameworks like the Green Bond Principles issued by the International Capital Market Association (ICMA).

The environmental impact of green bonds extends beyond simple financing; they foster transparency, benchmark progress toward green goals, and encourage accountability among issuers. For example, Apple Inc. made headlines by issuing a $1.5 billion green bond in 2016 to fund renewable energy projects supporting its data centers and retail operations worldwide. Reports indicated that this bond facilitated the installation of solar arrays and energy storage facilities that significantly reduced the carbon footprint of Apple’s supply chain.

Moreover, green bonds stimulate market innovation by attracting investors who prioritize Environmental, Social, and Governance (ESG) criteria. According to the Climate Bonds Initiative, investors hold an increasing preference for ESG-compliant assets, and green bonds have featured prominently in portfolios aiming to blend financial returns with sustainability.

Market Dynamics and Key Players

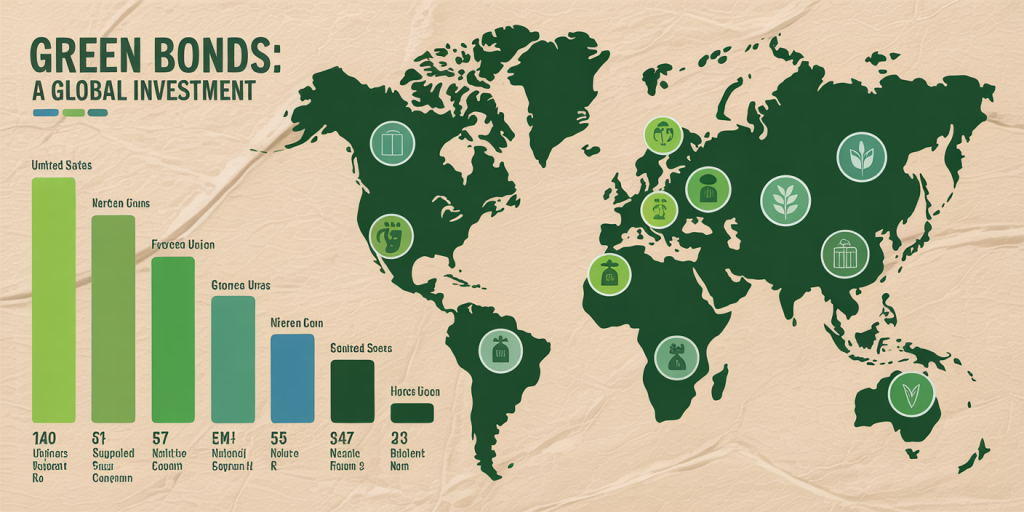

The global green bond market has witnessed robust expansion, with issuance growing from a mere $1 billion in 2007 to an estimated $650 billion in 2023. Geographically, the market is led by developed economies but shows rapid uptake in emerging markets, reflecting diverse local environmental priorities and investor bases. The United States, European Union, and China constitute the largest issuers, together accounting for nearly 70% of total issuance.

| Region | Green Bond Issuance 2023 (USD billion) | Percentage of Global Market (%) |

|---|---|---|

| United States | 180 | 27.7 |

| European Union | 160 | 24.6 |

| China | 110 | 16.9 |

| Emerging Markets | 90 | 13.8 |

| Others | 110 | 17.0 |

The profile of issuers spans sovereign governments, municipalities, supranational organizations, corporations, and financial institutions. For instance, in 2022, the French government issued a €7 billion green bond – the largest sovereign green bond at that time – to finance climate-related infrastructure, including sustainable transportation and energy efficiency projects. Such sovereign issuances provide benchmark yields and encourage other market participants to enter the green bond space.

Corporations from various sectors engage in green bond issuance. Tesla’s $1.8 billion green bond issue in 2021 was aimed at expanding its electric vehicle production and battery technology, signaling how green finance intersects with innovative clean tech industries. Financial institutions like Bank of America and HSBC have also issued green bonds, allocating proceeds to loans that support green mortgages or renewable energy initiatives.

Certification Standards and Transparency

A critical issue in the green bond market is ensuring the credibility of claims regarding environmental benefits. To address concerns about “greenwashing,” credible certification and reporting frameworks have become pivotal. The Green Bond Principles (GBP), developed by ICMA, establish voluntary process guidelines emphasizing transparency, disclosure, and accountability. They recommend issuers clearly communicate the use of proceeds, project evaluation and selection, management of proceeds, and periodic reporting.

Beyond the GBP, third-party verifications and certifications bolster investor confidence. The Climate Bonds Standard and Certification Scheme provides a rigorous assessment process verifying that projects and assets meet scientifically established criteria for low-carbon alignments. This can involve detailed lifecycle analysis, emissions reductions measurement, and impact assessments.

Reporting practices remain fundamental. Firms issued reports showcasing the allocation of proceeds and environmental outcomes. For example, the Asian Development Bank published a detailed impact report on its green bonds used to finance solar power and clean water projects across Asia, demonstrating quantifiable carbon emission reductions and community benefits.

Despite advancements, challenges persist. The absence of a universal standard complicates comparisons and investment decisions. Varying definitions of eligible projects by region or issuer can lead to skepticism. Market participants are actively discussing the development of regulatory frameworks, particularly within the European Union’s proposed Green Bond Regulation, which aims to standardize disclosure and boost market integrity.

Financial Performance of Green Bonds

An important consideration for investors is how green bonds perform financially relative to traditional bonds. Empirical analyses generally reveal that green bonds offer competitive returns while often exhibiting lower risk profiles due to their alignment with sustainable economic trends. In volatile markets, assets with ESG credentials tend to retain investor appeal and stability.

A 2022 study by MSCI compared the risk-adjusted returns of green bonds against conventional fixed-income securities over five years. The study found that green bonds had an average yield spread within 5 basis points of similar conventional bonds but exhibited lower default rates and higher price stability during economic shocks. This can be attributed to issuer quality—many green bonds come from sovereigns or blue-chip corporations—and the growing investor demand, which enhances liquidity.

| Metric | Green Bonds | Traditional Bonds |

|---|---|---|

| Average Yield Spread | +15 bps | +20 bps |

| Annualized Volatility | 3.1% | 4.0% |

| Default Rate (5-year) | 0.15% | 0.30% |

| Average Maturity (years) | 7.2 | 6.8 |

Green bonds also appeal to institutional investors with mandates to integrate ESG factors, resulting in steady demand. The financial community increasingly views green bonds not only as tools for impact but also as viable components of diversified portfolios. However, investors should still conduct due diligence on project risk, issuer credibility, and regulatory landscapes.

Challenges in Scaling Green Bonds

Despite promising growth, the green bond market encounters several barriers that could impede its full potential. One significant challenge involves project identification and eligibility. Many projects with positive environmental outcomes require large upfront capital and complex regulatory approvals, which limit the pipeline of investable projects. Moreover, smaller municipalities or companies often struggle to structure green bonds efficiently due to high issuance costs.

Another challenge relates to market fragmentation. Regional differences in standards, reporting, and certification have produced inconsistent interpretations of “green” credentials. This inconsistency can create confusion or mistrust among investors, reducing appetite for market participation. Furthermore, evolving regulatory regimes may impose additional compliance costs, especially where standards are nascent or under discussion.

There is also the risk of “greenwashing,” where issuers label bonds as green without sufficient environmental impact. Cases such as certain fossil fuel companies attempting to issue green bonds for marginally improved projects have raised concerns among watchdogs and investors. To combat this, increased transparency, standardized audits, and regulatory oversight are essential.

Lastly, measuring and verifying environmental impact remains complex. Quantifying carbon emissions reductions or biodiversity benefits involves multiple assumptions and methodologies, some of which lack consistency or are difficult to audit fully.

Future Perspectives: The Role of Green Bonds in Sustainable Finance

Looking ahead, green bonds are poised to play a central role in mobilizing finance for the sustainable development agenda. International commitments such as the UN Sustainable Development Goals (SDGs) and ongoing climate summits emphasize the necessity of scaling investment in green infrastructure and low-carbon technologies, where green bonds offer a practical mechanism.

Technological advancements, including blockchain and digital reporting platforms, promise to enhance transparency and traceability of green bond proceeds, boosting investor confidence. Digital green bonds, or “green bond tokens,” are already being piloted to facilitate trading and impact tracking in real-time.

The integration of social and sustainability-linked bonds with green bonds could broaden the market’s scope, combining environmental goals with social impact measurement, thereby attracting diverse investor types. Additionally, regulatory harmonization efforts, particularly within the European Union’s Green Bond Standard and China’s Green Bond Endorsed Project Catalogue, may lead to more uniform frameworks, fostering global investor participation.

Emerging economies are expected to become significant issuers as their infrastructure needs align with global sustainability criteria. For example, the African Development Bank aims to boost green bond issuance to fund projects dealing with climate resilience and renewable energy expansion across the continent.

In conclusion, green bonds represent a transformative financial instrument that not only raises capital but also drives accountability and innovation in sustainability financing. Through continued collaboration among governments, industries, and investors, the green bond market will expand its impact, supporting a resilient and greener global economy in the decades to come.

Deixe um comentário