Compound interest is often described as one of the most powerful forces in finance. Its ability to create exponential growth from relatively small investments over an extended period has made it a cornerstone strategy for building wealth. Understanding how compound interest works and leveraging it effectively can dramatically enhance your financial future. This article explores the concept of compound interest, examines its practical impact through examples, and discusses strategies to maximize its benefits for wealth accumulation.

The Fundamental Mechanics of Compound Interest

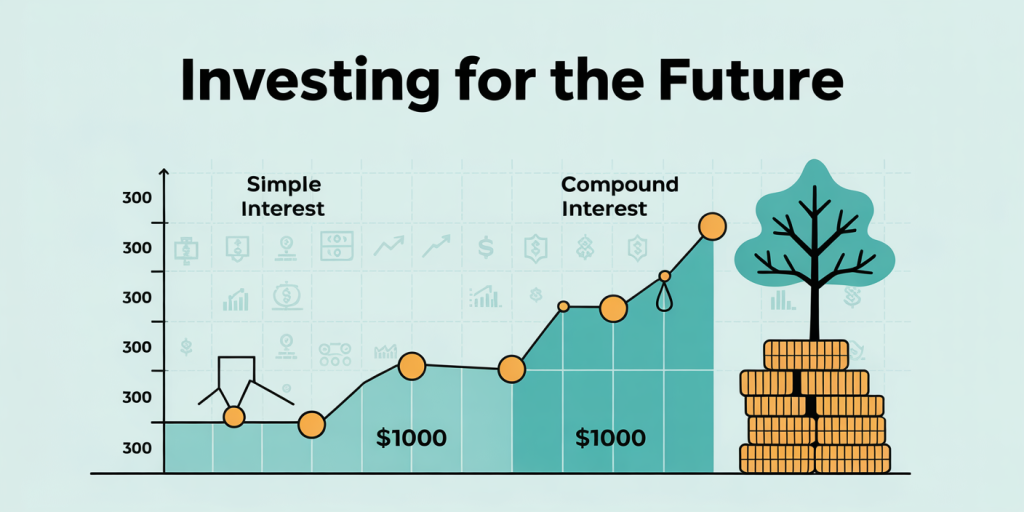

At its core, compound interest is the process where the interest earned on an initial principal amount also earns interest over successive periods. Unlike simple interest, where interest is calculated only on the original principal, compound interest calculates interest on the accumulated principal plus interest from previous periods. This recursive effect means the investment grows exponentially rather than linearly.

For instance, if you invest $1,000 at a 5% annual interest rate compounded yearly, after the first year, you earn $50 in interest, increasing your balance to $1,050. In the second year, the 5% interest applies to $1,050, resulting in $52.50, pushing the balance to $1,102.50. Over several years, this process accelerates growth significantly. The earlier and longer you invest, the more pronounced the effect becomes.

Practical Examples: Compound Interest in Action

Consider two investors: Alice and Bob. Alice starts investing $2,000 annually at age 25, with an expected average return of 7%, and stops at age 45. Bob starts investing the same amount each year but begins at 35 and continues until 65. Let’s compare their wealth accumulation at age 65 using compound interest.

Using the Future Value of an Annuity formula:

\[ FV = P \times \frac{(1 + r)^n – 1}{r} \] \(P\) = annual payment ($2,000) \(r\) = annual rate (7% or 0.07) \(n\) = number of years invested

| Investor | Years Investing | Total Contribution | Account Value at 65 (approx.) |

|---|---|---|---|

| Alice | 20 (25 to 45) | $40,000 | $117,000 |

| Bob | 30 (35 to 65) | $60,000 | $89,000 |

Despite investing less money overall ($40,000 vs $60,000), Alice ends up with more money at 65 due to starting earlier, highlighting how time amplifies compound growth. This example underscores the significance of early investing and patience when leveraging compound interest.

Compound Interest Versus Simple Interest: A Comparative Analysis

To better understand the power of compounding, it’s useful to compare it directly against simple interest. Here’s a look at how both interest types affect an initial investment of $10,000 over 30 years, at an annual rate of 6%.

| Year | Simple Interest Balance | Compound Interest Balance |

|---|---|---|

| 10 | $16,000 | $17,908 |

| 20 | $22,000 | $32,071 |

| 30 | $28,000 | $57,435 |

Simple interest here adds $600 each year, producing linear growth. In contrast, compound interest grows the investment much faster because interest gets earned on previously accumulated interest too. After 30 years, the compounding investment nearly doubles the value achieved through simple interest. This table clearly demonstrates why compound interest is more effective for wealth accumulation over time.

Real-World Application: Compound Interest in Retirement Savings

Retirement accounts such as 401(k)s and IRAs are prime vehicles for harnessing compound interest benefits. According to a 2023 report from Fidelity Investments, the average 401(k) balance for people aged 45-54 is around $150,000, illustrating how steady contributions and compound interest lead to substantial savings.

For example, a 30-year-old contributing $500 per month to a 401(k) with an average compound annual return of 7% can expect to accumulate approximately $570,000 by age 65. This calculation assumes contributions grow consistently and the market performs reasonably well. The key factor, again, is consistent contributions coupled with the multiplying effect of compound interest over decades.

Furthermore, reinvesting dividends in stocks or bonds boosts compound returns. Over 50% of the S&P 500’s total return historically comes from reinvested dividends, according to a 2021 study by Hartford Funds, highlighting how compounding not only includes interest but also reinvested income streams.

Strategies to Maximize Compound Interest Growth

To fully benefit from compound interest, several strategies should be considered:

1. Start Early and Invest Regularly

Time is the single most critical factor. The longer your money stays invested, the more compounding works in your favor. Even small amounts invested early accumulate to much larger sums than larger amounts invested later.

2. Reinvest Earnings Consistently

Whether it’s dividends, interest, or capital gains, reinvesting returns rather than taking them out of the investment keeps your principal growing and benefits compounding.

3. Choose Investments with Higher Compound Rates Carefully

Although higher rates can accelerate growth via compounding, they often come with higher risk. Balancing risk and return according to your financial goals and timeline is essential. Diversified portfolios that include stocks, bonds, and mutual funds can offer reasonable compound growth with managed risk.

4. Minimize Fees and Taxes

Investment fees and taxes can significantly reduce your effective compound rate. Low-cost index funds and tax-advantaged accounts help keep more of your earnings working for you.

Future Perspectives: Compound Interest in the Age of Digital Finance

Looking ahead, compound interest will remain a foundational principle of personal finance, but digital tools and innovation are transforming how investors access and apply compounding.

Robo-advisors, for example, automate regular investments and reinvest dividends, optimizing compounding without constant input from investors. According to a 2023 report by Statista, assets under management by robo-advisors are projected to exceed $2.5 trillion by 2025, reflecting growing trust in technology-driven investment strategies.

Additionally, the rise of fractional investing enables people to invest smaller amounts more frequently, enhancing the compound interest effect by facilitating earlier and consistent entry even with limited capital. Mobile apps now also provide instant insights on compound growth potentials, encouraging more disciplined saving habits.

On a macroeconomic level, ongoing low-interest environments challenge traditional compounding returns, prompting investors to explore alternative investment classes, such as real estate income trusts (REITs), peer-to-peer lending, and cryptocurrencies. While these can provide higher yields and hence faster compounding, they also introduce new risk dynamics.

As global financial literacy improves and technology integrates deeper into investing, the power of compound interest will likely become more accessible and better understood by broader demographics, helping more individuals build significant wealth over time.

—

In summary, compound interest is a time-tested, proven mechanism for accelerating wealth accumulation. Its exponential growth capability makes early, consistent investing essential for maximizing returns. By understanding how compound interest works, leveraging investment vehicles such as retirement accounts, and employing smart strategies, individuals can harness this powerful tool to secure their financial futures. With ongoing advancements in technology and investment platforms, the opportunity to benefit from compound interest will continue growing, making it more vital than ever to incorporate into a well-rounded financial plan.

Deixe um comentário