Money shapes much of human behavior, influencing decisions, relationships, and overall well-being. However, behind every financial choice lies a deep-rooted narrative — often unconscious — called a money script. These scripts are the beliefs and attitudes about money formed in childhood and reinforced throughout life. Understanding and rewiring these money scripts can empower individuals to break unhealthy financial cycles and build healthier monetary habits. This article delves into the concept of money scripts, their impact, and actionable steps to rewrite your financial story.

Understanding Money Scripts: The Foundation of Financial Behavior

Money scripts are foundational beliefs about money originating from family dynamics, cultural norms, and personal experiences. Psychologists popularized the term to explain how unconscious money messages influence financial decisions, often leading to limiting or destructive patterns. For example, a person raised in scarcity may develop a “money avoidance” script, causing anxiety around spending or saving.

Research from the Consumer Financial Protection Bureau (CFPB) highlights that nearly 60% of adults report emotional challenges related to money, such as anxiety or guilt. These emotions often stem from ingrained money scripts that are difficult to identify but profoundly affect financial wellness. Consider the case of Sarah, who grew up in a household where money was never discussed openly. As an adult, she struggles with budgeting, as she associates money topics with stress and conflict, demonstrating the script’s powerful deterrent effect.

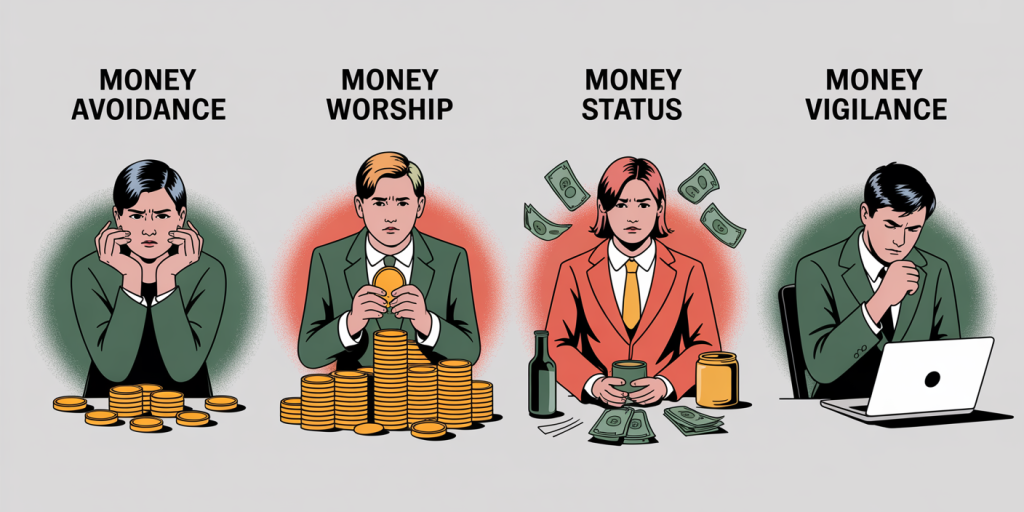

Money scripts fall into common categories, such as “Money Avoidance,” “Money Worship,” “Money Status,” and “Money Vigilance.” Each pattern predisposes individuals to certain financial behaviors — overspending, hoarding, or obsessively tracking expenses. Recognizing the specific script one lives by marks the first step toward positive change.

Common Money Scripts and Their Behavioral Impact

Each money script manifests uniquely but often has predictable outcomes. To illustrate, here is a comparative table showcasing common scripts alongside their typical behaviors and emotional consequences:

| Money Script | Typical Behaviors | Emotional Consequences |

|---|---|---|

| Money Avoidance | Avoiding financial discussions, denial of debt | Anxiety, guilt, financial stress |

| Money Worship | Obsession with wealth accumulation, risk-taking | Dissatisfaction, workaholism |

| Money Status | Spending to reflect social standing, keeping up with peers | Debt accumulation, insecurity |

| Money Vigilance | Extreme budgeting, reluctance to spend, hoarding funds | Stress, strained relationships |

For instance, individuals with a “Money Worship” script may believe that having more money equates to limitless happiness or power. John, a mid-level executive, epitomized this by working excessive hours to climb the corporate ladder, neglecting personal health and family. Despite his growing income, he never felt content, highlighting the hollow chase embedded in the script.

In contrast, “Money Avoidance” often leads to neglecting finances, incurring unpaid bills or avoiding investments. A study in the *Journal of Financial Therapy* found that clients recognizing these scripts were more successful in reshaping spending and saving habits than those who did not.

Identifying Your Money Script: Practical Steps

Becoming aware of your money script requires introspection and honest reflection about your relationship with money. Start by journaling your earliest memories about money — were there any repetitive messages or emotional reactions? Answers may reveal an unconscious narrative.

A practical exercise involves analyzing your financial decisions for patterns. Ask: Do I spend impulsively or avoid budgeting? Do I equate my self-worth to my bank balance? Do I fear discussing money or feel guilty spending it?

Also, consider feedback from close relatives or friends who observe your money behaviors objectively. Therapy or coaching can provide professional help to unearth these scripts.

Take the example of Maria, who discovered through therapy that her compulsive shopping was rooted in a “Money Status” script, passed down from a family culture valuing material success. After uncovering this, she set realistic goals and consciously shifted spending to align with her values. This shift led to a 25% reduction in her monthly expenses within six months, alongside increased satisfaction.

Rewriting Money Scripts: Strategies for Financial Transformation

Once identified, rewriting money scripts involves conscious efforts to challenge and replace limiting beliefs. Cognitive Behavioral Therapy (CBT) techniques, such as thought records, help individuals replace dysfunctional financial thoughts with healthier ones. For example, transforming “I will never have enough” to “I can create financial stability through planning and action.”

Financial education further disrupts scripts by equipping individuals with necessary skills and knowledge. Learning about budgeting, investing, and credit management builds confidence and counters fear or avoidance.

Moreover, goal setting transforms abstract fears into actionable plans. Breaking long-term goals into small, measurable steps provides motivation and proof of progress. For instance, a person who fears debt might set a goal to reduce credit card balances by 10% every month.

Another technique involves financial affirmations — positive statements such as “I deserve financial security,” repeated daily, build new neural pathways that reinforce positive money beliefs over time.

Case Studies: Successful Money Script Rewrites

Real-life examples powerfully illustrate the benefits of revising money scripts.

Case Study 1: David and Money Vigilance

David was notoriously frugal to the point of deprivation, missing out on social events to save pennies. This “Money Vigilance” stemmed from childhood experiences of poverty. His financial coach helped him create a balanced budget allocating 10% for leisure. Over a year, David’s relationships improved, and he reported higher life satisfaction, demonstrating that rewriting scripts also enhances overall well-being.

Case Study 2: Linda Overcoming Money Worship

Linda equated success with making six figures, leading to burnout. After working with a financial therapist, she defined success by personal fulfillment rather than income. She reduced work hours, diversified income sources, and started volunteering. Her net worth stabilized while her mental health and happiness soared.

The Role of Financial Literacy in Changing Money Narratives

Understanding financial principles plays a critical role in breaking old money scripts. Without basic literacy, individuals remain susceptible to impulsive decisions driven by outdated beliefs or misinformation. According to the National Financial Educators Council, individuals who receive financial education experience a 30% increase in savings and are 20% less likely to carry credit card debt.

Educational programs tailored to recognize psychological barriers alongside financial skills have shown promise. Institutions offering courses on emotional finances report higher engagement and longer retention of financial habits.

A comparative analysis between traditional finance courses and those incorporating psychological elements reveals significant differences:

| Aspect | Traditional Finance Education | Integrated Behavioral Finance Education |

|---|---|---|

| Focus | Budgeting, investing basics | Financial skills + psychological insight |

| Participant Engagement | Moderate | High |

| Improvement in Behavior | 45% | 70%+ |

| Retention of Habits | 50% | 80% |

This data underscores the synergy between knowledge and mindset in fostering sustainable financial wellness.

Looking Ahead: Future Perspectives on Money Scripts and Financial Health

As financial landscapes evolve with technology, remote work, and personalized financial tools, the awareness and transformation of money scripts become even more critical. Emerging fields like neurofinance explore how brain mechanisms influence economic decisions, promising novel interventions tailored to individual psychological profiles.

Artificial Intelligence-driven financial coaching apps are beginning to incorporate money script assessments, providing real-time personalized feedback to guide users in breaking negative patterns. For example, tools that monitor spending spikes linked to emotional triggers could alert users and suggest coping strategies.

Moreover, societal trends emphasize mental health integration into financial planning, recognizing that emotional and cognitive well-being profoundly impact money management. Employers and policymakers increasingly advocate for financial wellness programs that address both education and emotional support.

The future holds the promise of a more holistic approach, combining psychology, education, and technology to rewrite money stories at scale — fostering equity and well-being.

Understanding and rewriting money scripts is a transformative journey that opens the door to healthier financial behaviors and enriched lives. By identifying unconscious beliefs, employing targeted strategies, and embracing financial education, individuals can reclaim control over their financial destinies and build legacies rooted in empowerment rather than fear. The evolution of this field hints at a future where everyone can narrate a financial story of resilience and success.

Deixe um comentário