Owning a home is often presented as a cornerstone of the “American Dream” and a pivotal step toward financial stability and personal freedom. While purchasing a property certainly offers benefits such as equity building, stability, and a sense of community belonging, many prospective homeowners overlook the hidden expenses that come with this investment. Homeownership involves far more than just the mortgage payment and property taxes; it encompasses a myriad of ongoing and unexpected costs that can significantly impact your financial well-being.

Understanding these concealed expenses is crucial for any prospective buyer or current homeowner aiming to manage their budget effectively and avoid financial surprises. This article delves into the various hidden costs associated with homeownership, supported by practical examples, real-life cases, and data-driven insights.

Initial Context: Beyond the Down Payment and Mortgage

When most people consider buying a home, their primary calculations focus on the down payment, monthly mortgage payments, and property taxes. For example, according to the National Association of Realtors (NAR), the median existing-home price in the United States was approximately $407,700 in 2023, with an average down payment of around 6%. While these figures are significant, they do not account for the routine and irregular expenses a homeowner will face.

Many first-time buyers face sticker shock when they realize that utility bills, maintenance, insurance, and other fees cumulatively add up to a substantial monthly outflow. A study by the U.S. Bureau of Labor Statistics noted that the average annual expenditure on housing-related costs is nearly 33% of total household expenses, often underestimated when budgeting for homeownership.

Maintenance and Repairs: The Unseen Burden

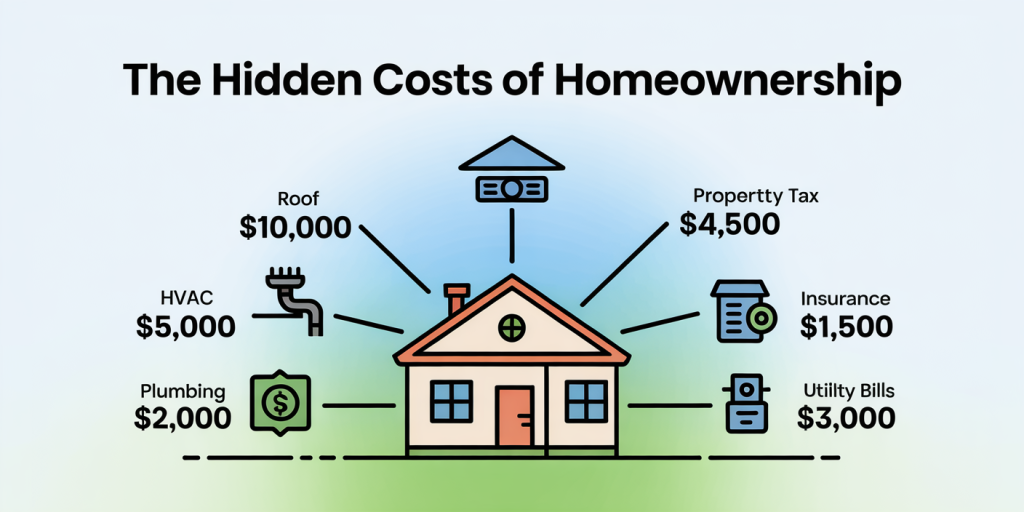

A key overlooked cost is home maintenance and repairs. Unlike renting, where landlords typically cover upkeep, homeowners are responsible for all fixes and replacements. This can range from small fixes like repairing a leaking faucet to major undertakings like replacing a roof or fixing a foundation.

On average, HomeAdvisor reports that homeowners spend around 1-4% of their home’s value annually on maintenance. For a $400,000 home, that equates to $4,000 to $16,000 per year. Real-life cases illustrate this well; for example, John and Lisa Thompson from Ohio faced an unexpected $7,500 cost to replace their HVAC system just two years after buying their home.

Preventative maintenance, though often neglected, is critical to avoid these sudden expenses. Tasks such as gutter cleaning, lawn care, and HVAC servicing might seem minor but add up both in time and cost. The inability or unwillingness to perform regular maintenance can significantly reduce a home’s value and lead to costlier repairs down the line.

| Maintenance Task | Average Annual Cost | Frequency | Notes |

|---|---|---|---|

| HVAC Maintenance | $150-$500 | Biannual | Essential to prevent major failure |

| Roof Inspection | $100-$300 | Every 2-3 years | Early problem detection |

| Plumbing Repairs | $150-$1,000 | As needed | Urgent issues can be costly |

| Landscaping & Lawn Care | $1,200-$2,000 | Seasonal | Essential for curb appeal |

Property Taxes and Insurance: Beyond the Mortgage

While monthly mortgage payments are well advertised, they often only represent part of the total housing expense. Property taxes and insurance premiums vary widely depending on location, home value, and local regulations but can significantly impact the overall cost of homeownership.

In areas like New Jersey and Illinois, property taxes can exceed 2% of the home’s assessed value annually, making them some of the highest in the country. For instance, a $400,000 home in Bergen County, NJ, could result in an annual property tax bill of $8,000 or more. By comparison, certain states like Hawaii have property taxes under 0.3%, showing stark geographical disparities.

Homeowners insurance is another critical expense. According to the Insurance Information Institute, the average premium in the U.S. in 2023 was about $1,700 annually. However, factors such as location (proximity to flood zones or wildfire-prone areas) can lead to premiums doubling or tripling. For example, homeowners in California’s wildfire hotspots have seen insurance rates increase by over 30% between 2020 and 2023.

| Location | Average Property Tax Rate | Average Home Value | Estimated Annual Property Tax | Average Homeowners Insurance Premium |

|---|---|---|---|---|

| Bergen County, NJ | 2.13% | $400,000 | $8,520 | $1,800 |

| Miami-Dade, FL | 1.22% | $350,000 | $4,270 | $2,300 |

| Dallas County, TX | 1.86% | $320,000 | $5,952 | $1,600 |

| Honolulu, HI | 0.28% | $700,000 | $1,960 | $1,500 |

Utilities and Daily Living Expenses

Another often underestimated segment of homeownership costs is utility bills and other daily living expenses that typically rise with homeownership. Renters may live in smaller spaces or share utilities with landlords, but owning a home often means paying fully for electricity, water, gas, trash, and sewer.

Larger homes tend to have higher utility costs. For example, according to the U.S. Energy Information Administration, the average annual electricity consumption for a U.S. residential utility customer was approximately 10,632 kWh in 2023. A homeowner in a 2,500-square-foot house can expect higher costs compared to a renter in a 900-square-foot apartment.

Outdoor water usage, typically for irrigation and landscaping, adds further expense. In the western U.S., this can be significant, especially with drought issues. For instance, California homeowners report that their water bills often double during summer months to maintain lawns and gardens.

Opportunity Cost and Financial Flexibility

While the tangible costs are critical to consider, there is a less visible financial factor—the opportunity cost of money tied up in homeownership. Purchasing a home typically requires a large upfront down payment and continuous reinvestment in property maintenance. The capital locked in the home is illiquid, limiting financial flexibility.

By contrast, renters may have more disposable income and the ability to invest funds in diversified portfolios which historically offer higher returns than real estate appreciation. According to a study by the Federal Reserve, the average annual home price appreciation in the U.S. is roughly 3-5%, whereas the stock market has yielded an annualized return of around 7-10% over the long term.

Moreover, homeownership may limit relocation flexibility for jobs or personal reasons, potentially leading to higher costs related to commuting or constrained career opportunities. The transactional costs of buying and selling properties—averaging 6-10% of a home’s sale price including agent commissions—add to this financial burden.

Future Perspectives: Navigating Rising Costs and Market Dynamics

Looking ahead, the hidden costs of homeownership are likely to become more pronounced due to several macroeconomic and environmental factors. Climate change, for instance, is increasing the frequency and severity of natural disasters, driving up insurance premiums and repair costs. In coastal and wildfire-prone areas, some insurers are pulling out of the market, forcing homeowners to seek expensive alternatives.

Additionally, inflation has driven up costs for construction materials and labor by 15% or more in recent years, according to the U.S. Bureau of Labor Statistics. As a result, routine repairs and renovations have become more costly, and home renovation backlogs mean longer wait times and potentially higher interim costs.

Technological advancements, however, offer some hope. Smart home systems and energy-efficient appliances can reduce utility expenses significantly over time. For example, the U.S. Department of Energy estimates potential savings of $200-$500 annually by upgrading to ENERGY STAR certified appliances.

Government policies may also impact future hidden costs. Some cities are implementing stricter building codes and environmental regulations to improve resilience and sustainability, which may increase upfront costs but reduce long-term expenses related to damage or inefficiency.

For prospective and current homeowners, comprehensive budgeting, leveraging technological solutions, and staying informed about local market and environmental trends will be critical strategies going forward.

—

Homeownership is undoubtedly a valuable milestone but requires careful financial planning beyond the visible expenses of mortgage payments. By understanding and preparing for the hidden costs—maintenance, taxes, insurance, utilities, and the opportunity costs—homeowners can safeguard their investment and enjoy the benefits of owning a home without unexpected financial strain. Awareness and proactive management remain key to turning the dream of homeownership into a sustainable reality.

Deixe um comentário