Understanding the intricate relationship between psychological factors and financial behavior has become increasingly significant in personal finance studies. Among these factors, self-esteem stands out as a powerful influencer of how individuals manage their money, make spending decisions, and plan for the future. Self-esteem, defined as one’s overall sense of self-worth or personal value, impacts daily choices that, collectively, shape financial stability and security.

Research reveals that people with differing levels of self-esteem exhibit varied financial habits, affecting their credit scores, savings patterns, and investment decisions. This connection is crucial not only for individuals aiming to improve their financial health but also for financial advisors, therapists, and policymakers seeking to devise better support tools and interventions. This article explores this multifaceted connection, elaborating on how self-esteem influences financial behaviors, backed by practical insights and empirical data.

Psychological Foundations of Self-Esteem and Money Management

Self-esteem fundamentally shapes how individuals perceive their ability to control finances. People with high self-esteem tend to believe in their capability to budget effectively, negotiate salaries, and make informed investment choices. This confidence translates into proactive financial habits such as regular saving, avoiding unnecessary debt, and prioritizing long-term financial goals. For instance, a 2018 survey conducted by the National Endowment for Financial Education (NEFE) found that 68% of individuals reporting high self-esteem were more likely to have a financial plan in place compared to only 32% of those with low self-esteem.

Conversely, low self-esteem often triggers avoidance behaviors and impulsive financial decisions. Individuals doubting their financial literacy or self-worth may avoid budget tracking, delay bill payments, or engage in retail therapy as a coping mechanism, leading to financial instability. A psychological study by the University of Cambridge in 2021 indicated that individuals with low self-esteem showed a 25% greater tendency toward impulsive purchases, which exacerbated debt accumulation. These findings suggest that boosting self-esteem could be integral to cultivating healthier financial habits.

How Self-Esteem Influences Spending and Saving Patterns

Money management behaviors are often reflections of deeper emotional and cognitive patterns. High self-esteem encourages disciplined spending and consistent saving habits. People confident in themselves usually set realistic budgets and stick to them, balancing needs and wants effectively. For example, consider Sarah, an IT consultant with high self-esteem, who systematically allocates 20% of her monthly income to savings and investments. Her positive self-regard helps her resist impulsive buys because she values future financial security over momentary gratification.

On the other hand, individuals with low self-esteem may use spending as a way to boost mood temporarily but often at the cost of long-term financial health. John, struggling with low self-worth and job insecurity, frequently indulges in impulsive purchases like gadgets and luxury items to seek validation and comfort. These frequent purchases, often funded through credit cards, create a cycle of debt and stress, further lowering his self-esteem. Real-world financial coaching programs report that addressing self-esteem issues significantly improves budgeting adherence and reduces impulsivity.

The table below compares typical spending and saving patterns between individuals with high and low self-esteem based on multiple behavioral finance studies:

| Financial Behavior | High Self-Esteem Individuals | Low Self-Esteem Individuals |

|---|---|---|

| Monthly Savings Rate | 15-25% of income | Less than 10% or irregular saving |

| Budgeting Practice | Regularly maintains and reviews budgets | Avoids or inconsistently manages budgets |

| Use of Credit | Cautious, pays off balances timely | Reliant on credit, often carries high balances |

| Impulse Purchases | Rare and controlled | Frequent and emotional |

| Financial Planning | Long-term oriented (retirement, investments) | Short-term, focused on immediate needs |

The Role of Self-Esteem in Debt Management and Credit Use

Debt management strategies and credit behavior are significantly influenced by self-esteem levels. High self-esteem empowers individuals to approach debt with a strategic mindset—evaluating interest rates, prioritizing repayments, and negotiating terms. A real case highlights this well: Maria, a marketing executive with high self-esteem, confronted her student loans by refinancing for better rates and creating a repayment timeline aligned with her financial goals. Her confidence also helped her maintain good credit habits, resulting in a credit score above 780.

Conversely, individuals with low self-esteem might view debt as overwhelming and uncontrollable, which can foster avoidance or denial. This may cause missed payments, higher interest penalties, and a declining credit score. Financial counselors regularly observe clients who feel ashamed of their debt, leading to procrastination in seeking help—perpetuating financial distress. A Journal of Consumer Research article in 2022 underscored the correlation between low self-esteem and poor credit management, emphasizing that self-esteem-enhancing interventions contributed to better debt outcomes.

Debt stress also feeds back negatively on self-esteem, creating a vicious cycle. Individuals who feel trapped by debt may experience feelings of failure and diminished self-worth, which can impact mental health and reduce financial resilience. Understanding this interplay is essential for designing effective debt counseling programs.

Self-Esteem and Investment Decisions: Risk Tolerance and Confidence

Investment choices are another area where self-esteem plays a pivotal role. Confident individuals tend to have a higher risk tolerance, allowing them to diversify portfolios and take calculated risks that may yield better returns over time. For example, a 2020 Fidelity Investments report found that investors with strong self-confidence were 40% more likely to engage with diversified assets like stocks, mutual funds, and real estate.

However, overconfidence—which can resemble inflated self-esteem—can lead to risky, sometimes reckless, investment behaviors, such as frequent trading or chasing speculative opportunities without adequate research. Balanced self-esteem supports informed decision-making, where individuals trust their judgment but remain open to learning and advice.

In contrast, people with low self-esteem may either avoid investing altogether due to fear of failure or choose overly conservative options, missing out on growth opportunities. Consider a retiree hesitant to invest in mutual funds despite financial advisor recommendations, opting instead to keep funds in low-yield savings accounts. Such behavior may impair long-term financial security.

The table below summarizes how varying self-esteem levels relate to investment behaviors:

| Investment Behavior | High Self-Esteem | Low Self-Esteem |

|---|---|---|

| Risk Tolerance | Moderate to high with calculated risks | Low risk tolerance; preference for safe assets |

| Portfolio Diversification | Broad diversification | Limited diversification |

| Confidence in Decision-Making | High, but open to advice | Low, leading to avoidance or indecision |

| Emotional Reaction to Market | Calm during volatility | Anxiety, leading to impulsive withdrawals |

| Investment Frequency | Balanced approach, avoiding hasty trades | Either avoidance or sporadic, emotion-driven trades |

Practical Strategies to Enhance Self-Esteem for Better Financial Health

Improving self-esteem can lead to more sound financial practices. One practical approach is cognitive-behavioral therapy (CBT), which helps individuals restructure negative beliefs about money and personal competence. Financial therapists often incorporate CBT techniques, enabling clients to replace self-defeating thoughts with constructive affirmations related to money management.

Another effective strategy is goal setting with measurable milestones. When individuals set small, achievable financial goals—such as saving $500 for an emergency fund within three months—they build confidence through demonstrated success. This gradually elevates self-esteem and motivates continued positive behavior.

Educational programs also play a critical role. For example, the Jump$tart Coalition for Personal Financial Literacy advocates for integrated curricula combining financial knowledge with personal development skills, including self-esteem building. Studies from the Consumer Financial Protection Bureau (CFPB) show that participants in such programs improved their financial confidence by 30%, leading to better credit use and saving habits.

Moreover, peer support groups and money coaching provide emotional support and accountability, further enhancing self-worth and financial decision-making.

Looking Ahead: The Future of Financial Wellness Integrating Psychological Insights

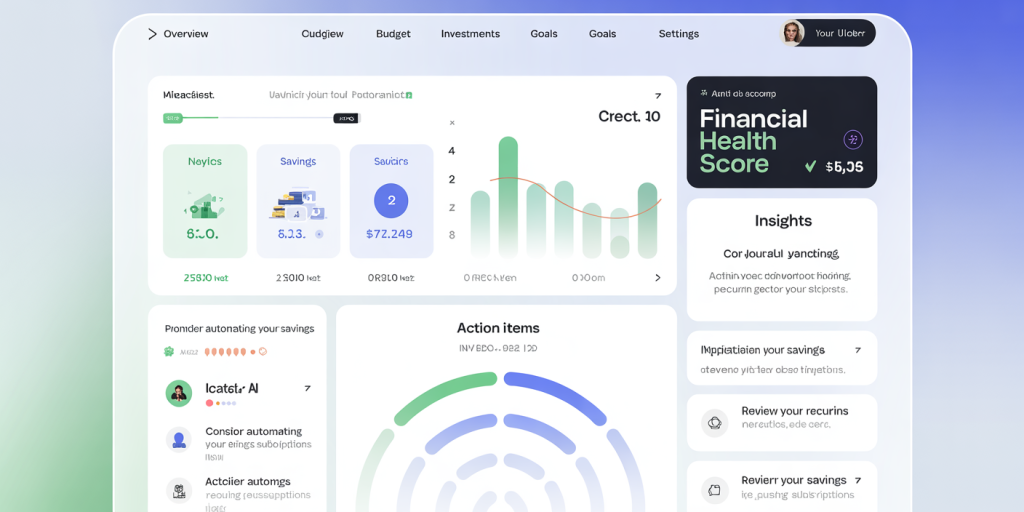

The evolving landscape of financial wellness increasingly recognizes the importance of psychological factors like self-esteem. As technology advances, digital financial platforms are beginning to incorporate behavioral nudges and personalized coaching that address emotional and cognitive aspects alongside traditional financial metrics.

Artificial intelligence (AI)-powered tools are being designed to detect patterns indicative of low self-esteem-related financial behaviors, such as impulsive spending or procrastination in bill payments. Through real-time feedback and encouragement, these platforms aim to improve user confidence and promote better money habits.

Policy initiatives are also shifting to incorporate mental health and self-worth considerations into financial literacy programs. For instance, several governments are funding research and community workshops focusing on holistic financial education that blends psychology and finance.

Looking to the future, the integration of neuroscience, behavioral economics, and personal finance promises a more comprehensive understanding of how self-esteem intersects with financial habits. This will likely result in more tailored interventions and support systems, potentially reducing financial insecurity on a broad scale.

In summary, cultivating healthy self-esteem not only benefits emotional well-being but is a cornerstone for responsible financial behavior. As research and practice advance, acknowledging this connection will be vital for individuals, educators, and professionals working toward greater financial resilience and success.

Deixe um comentário