Real Estate Investment Trusts (REITs) have become a cornerstone investment vehicle worldwide, offering investors a unique blend of income, diversification, and exposure to real estate without directly owning property. While REITs originated in the United States, their expansion into international markets reflects the global demand for accessible real estate investment options. Understanding how REITs operate across different countries is crucial for investors looking to diversify their portfolios internationally and for financial professionals exploring cross-border real estate trends.

The Fundamental Structure of REITs Globally

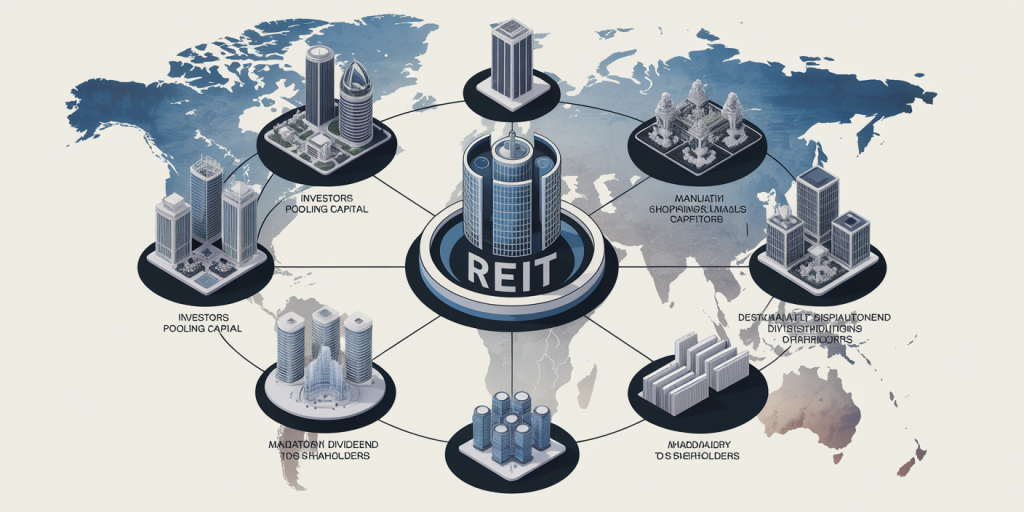

REITs are corporate entities that own, operate, or finance income-generating real estate. The basic premise is consistent worldwide: REITs pool capital from numerous investors to purchase large-scale properties, such as office buildings, shopping malls, apartments, warehouses, or hotels. What distinguishes REITs from traditional real estate companies is the regulatory requirement to distribute a significant proportion of taxable income—typically at least 90%—to shareholders as dividends. This distribution obligation ensures steady income streams for investors.

However, the specific legal frameworks, tax regimes, and operational requirements vary significantly depending on the country. For example, in the U.S., REITs must comply with the Internal Revenue Code Section 856, while in Japan, the J-REIT structure follows rules under the Japanese Financial Instruments and Exchange Act. These regulatory differences affect the types of assets held, dividend yields, taxation of returns, and investor protections.

A practical case is the well-known American Tower Corporation, which operates as a REIT in the U.S., primarily in telecommunications infrastructure, whereas CapitaLand Integrated Commercial Trust represents a significant Singapore REIT investing primarily in commercial real estate in Southeast Asia. Both models emphasize steady income distribution but cater to different real estate sectors and investor bases.

Variations in REIT Types and Market Maturity

International markets demonstrate diverse REIT classifications and maturity levels. Mature markets, such as the U.S., Canada, Australia, and Singapore, feature a wide range of REIT types, including equity REITs, mortgage REITs, and hybrid REITs. Equity REITs own and manage physical properties, mortgage REITs invest in real estate debt, and hybrid REITs combine both strategies.

In contrast, emerging markets like India and Brazil often have nascent REIT ecosystems, predominantly dominated by equity REITs but with limited liquidity and regulatory frameworks still evolving. India launched its first publicly traded REIT in 2019, Embassy Office Parks REIT, which holds significant office assets across key urban centers and has attracted substantial foreign investment due to its growth potential.

Table 1 illustrates the comparative overview of REIT market maturity and dominant types in select countries:

| Country | Market Maturity | Dominant REIT Type | Notable REIT Example | Dividend Yield (Approx.) |

|---|---|---|---|---|

| United States | Highly Mature | Equity, Mortgage, Hybrid | American Tower Corporation | 3.5% – 5% |

| Singapore | Mature | Equity | CapitaLand Integrated Commercial Trust | 4% – 6% |

| Japan | Mature | Equity | Nippon Building Fund | 3% – 4% |

| India | Emerging | Equity | Embassy Office Parks REIT | 5% – 7% |

| Brazil | Emerging | Equity | BR Properties | 6% – 8% |

This table highlights how dividend yields vary with market development and asset types. Mature markets often offer more stability but slightly lower yields, while emerging markets may deliver higher yields paired with increased risk.

Cross-Border Investment Dynamics and Challenges

Investing in international REITs presents unique opportunities for diversification but also involves challenges such as currency risks, regulatory differences, and taxation complexities. Currency appreciation or depreciation can have a significant impact on the returns of foreign REIT investments. For example, U.S. investors in European REITs must consider the Euro to USD exchange rate fluctuations, which can either boost or erode returns independent of the REIT’s performance.

Regulatory environments are also diverse. In Australia, REITs are known as Australian Real Estate Investment Trusts (A-REITs) and are registered with the Australian Securities Exchange (ASX). Local tax laws may provide preferential treatment on dividends, but foreign investors must be aware of withholding taxes and possible double taxation treaties. Meanwhile, Canada’s REITs benefit from specific tax exemptions on income distributed, making Canadian REITs attractive to both domestic and international investors.

A practical example involves the diversified portfolio of Prologis, a U.S.-based global logistics REIT with assets in North America, Europe, and Asia. Prologis’s global footprint enables it to capitalize on diverse market conditions but also creates complexity in managing cross-border regulatory compliance and currency risk hedging.

Dividend Policies and Tax Implications Across Borders

One of the most appealing features of REITs is the steady income they provide through dividends. However, international investing complicates dividend taxation because each country imposes different withholding tax rates on dividends paid to foreign investors. These can range from zero in certain tax treaty agreements to upwards of 30% in the absence of such agreements.

For example, U.S. REITs typically impose a 30% withholding tax on dividends paid to non-resident aliens unless mitigated by tax treaties (such as the U.S.-UK treaty reducing the rate to 15%). In contrast, Singapore REITs often have low or zero withholding taxes, making them particularly attractive for international investors seeking tax-efficient income.

Investors must also consider tax treatment on capital gains from the disposal of REIT units. Some countries impose capital gains tax, while others exempt gains resulting from REIT shares. This variation influences portfolio allocation decisions when selecting REITs for international diversification.

An investor in UK REITs, for instance, benefits from a tax-transparent status for the REIT itself, with dividends treated as property income, which may be taxable or exempt depending on the investor’s residency and overall tax circumstances.

The Role of Technology and Global Trends in REIT Evolution

Advancements in technology and evolving global economic dynamics have played a pivotal role in shaping the future of REITs internationally. The rise of data centers, logistics hubs, and telecommunications infrastructure has spawned specialized REITs focusing on these sectors.

For example, Digital Realty Trust, a U.S.-based data center REIT, has expanded internationally, capitalizing on the surging demand for cloud computing infrastructure. Similarly, Singapore’s Mapletree Commercial Trust has diversified into data centers alongside traditional retail and office spaces.

Furthermore, Environmental, Social, and Governance (ESG) considerations have become part of the investment criteria for many international REITs. Investors increasingly seek REITs that adhere to sustainable practices, which can impact long-term asset values and rental demands. Markets like Europe spearhead these initiatives with stringent sustainability reporting requirements, encouraging property owners to invest in green building technologies.

E-commerce’s ongoing expansion has accelerated demand for modern logistics properties, shifting REIT portfolios internationally. Prologis’s stronghold in global logistics assets, spanning across Europe, Asia, and the Americas, illustrates how REITs adapt to market trends to meet investor demands.

Looking Ahead: Future Perspectives for REITs in International Markets

The international REIT market is poised for substantial evolution as regulatory frameworks harmonize and investors seek greater exposure to real estate across borders. Emerging markets such as China, South Korea, and parts of Latin America are expected to deepen their REIT markets, fueled by urbanization, infrastructure development, and financial market maturation.

Technological integration will likely further enhance REIT operational efficiencies through better asset management, tenant relations, and portfolio analytics. Countries with advanced digital infrastructure stand to lead REIT innovations.

Another significant future trend is the widening investor base participating in international REITs, including retail investors gaining access through exchange-traded funds (ETFs) focused on global REIT portfolios. This democratization encourages more capital flows into international real estate, mitigating risks associated with investing in single markets.

Investors should also monitor geopolitical tensions and macroeconomic factors such as interest rate fluctuations, inflation, and government policies affecting property ownership. Countries with investor-friendly reforms will naturally attract more foreign REIT investments.

Continuous innovation in ESG compliance, regulatory transparency, and tax harmonization could position international REITs as a primary avenue for real estate investing worldwide. Thus, investors equipped with global knowledge and strategic diversification stand to benefit significantly from the expanding REIT universe.

—

References: National Association of Real Estate Investment Trusts (NAREIT), 2023. Singapore Exchange (SGX) REIT Annual Reports, 2023. Embassy Office Parks REIT, India, IPO Prospectus, 2019. Prologis Annual Sustainability Report, 2023. PwC Global REIT Report, 2022. OECD Tax Database on Withholding Taxes, 2023.

Deixe um comentário