Financial literacy is a critical life skill that enables individuals to manage their money wisely, make informed financial decisions, and achieve economic well-being. Yet, despite its undeniable significance, financial education remains glaringly absent or inadequate in many school curricula worldwide. The increasing complexity of the economic landscape, coupled with rising levels of personal debt and financial insecurity, underscores the urgent need to incorporate financial literacy into formal education. This article delves into why financial literacy should be taught in schools, supported by data, practical examples, and a detailed exploration of its far-reaching benefits.

The Growing Importance of Financial Literacy in Today’s World

The financial landscape has changed dramatically over the past few decades. From the proliferation of credit cards and online banking to the complexities of student loans and investment options, young people face more financial choices than ever before. However, many lack the foundational knowledge necessary to navigate this environment confidently. According to the National Financial Educators Council, around 60% of all adults do not have a budget or financial plan, illustrating a widespread gap in essential money management skills.

In the United States alone, a 2023 report by the U.S. Financial Literacy and Education Commission revealed that only 17 states required high school students to complete a personal finance course to graduate. This lack of standardized financial education exposes young adults to poor money habits that can lead to long-term consequences such as credit card debt, inadequate savings, and poor investment decisions. For example, a survey conducted by the FINRA Investor Education Foundation found that nearly two out of five adults could not pass a basic financial literacy test designed to assess knowledge about interest rates, inflation, and risk diversification.

Enhancing Personal Financial Management Skills

One of the most direct benefits of teaching financial literacy in schools is improving students’ personal money management skills. When taught how to budget, save, and understand credit, students develop habits that can significantly reduce financial stress throughout their lives. Early education on basic concepts such as compound interest and the importance of emergency funds empowers students to set realistic financial goals and plan for the future.

A practical example can be seen in the state of Utah, which implemented mandatory financial education in high schools in 2011. Post-implementation, surveys indicated that students in Utah were more likely to save regularly and avoid high-interest debt compared to peers from states without such requirements. Financial literacy instruction also helps young people understand the pitfalls of predatory lending and scam investments, reducing their vulnerability to such financial risks.

Bridging Inequality Through Financial Education

Financial literacy is a powerful tool for reducing economic inequality. Research shows that marginalized communities often suffer from lower levels of financial knowledge, which can exacerbate poverty and limit upward mobility. Teaching financial literacy in schools can equip all students with the essential skills needed to build wealth, regardless of their socioeconomic background.

For instance, the Jump$tart Coalition for Personal Financial Literacy highlights that students from low-income families benefit the most from structured financial education. By learning about budget management, affordable credit use, and saving strategies at a young age, these students can break cycles of financial hardship. A study published in the Journal of Consumer Affairs found that financial education significantly increased financial confidence and economic resilience among economically disadvantaged high school students.

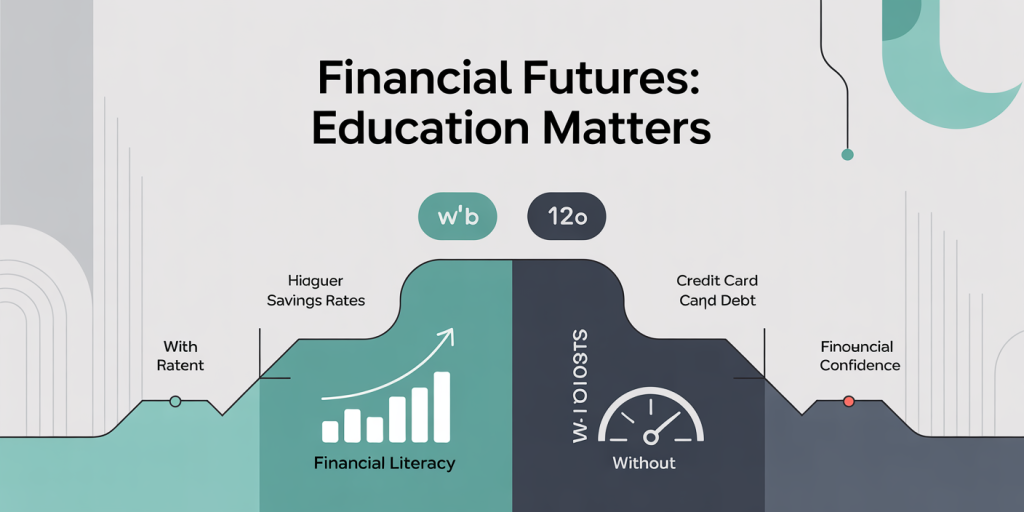

The following table illustrates comparative outcomes between schools with and without financial literacy programs in economically disadvantaged areas:

| Outcome | With Financial Literacy Education | Without Financial Literacy Education |

|---|---|---|

| Percentage of students saving regularly | 65% | 35% |

| Average credit card debt upon graduation | $1,200 | $3,400 |

| Financial decision-making confidence | High | Low |

| Percentage pursuing post-secondary education | 75% | 50% |

Supporting Long-Term Economic Stability

Beyond individual benefits, teaching financial literacy in schools promotes broader economic stability. When a population is financially literate, it leads to more responsible borrowing, increased saving rates, and informed investing, which in turn contributes to the overall health of the economy.

During the 2008 financial crisis, researchers identified a significant correlation between lack of financial knowledge and high default rates on mortgages. Many borrowers did not fully understand adjustable-rate mortgages (ARMs) or the risks associated with subprime loans, contributing to widespread foreclosures. If financial literacy had been more widespread, many of these risks could have been mitigated.

Countries with robust financial education programs typically experience lower levels of household debt and better retirement savings rates. For example, Australia requires personal finance education as part of its national curriculum. This has been linked to higher levels of retirement savings and improved debt management compared to countries without such requirements, according to a report by the Organisation for Economic Co-operation and Development (OECD).

Integrating Financial Literacy into School Curricula: Best Practices and Challenges

Implementing financial literacy education effectively requires careful planning and resources. Schools must develop age-appropriate curricula that cover fundamental topics such as budgeting, credit, investing, taxes, insurance, and retirement planning. It is crucial to integrate these lessons into existing math, social studies, or economics classes rather than burden students with additional courses.

Practical, hands-on approaches have been shown to yield better results. For example, simulation games that emulate real-life financial decisions can increase engagement and retention. Additionally, involving parents and the community through workshops can reinforce financial concepts learned at school.

However, challenges remain, including insufficient teacher training and lack of standardized benchmarks for financial education outcomes. Many educators report feeling unprepared to teach personal finance, highlighting the need for professional development. Budget constraints also limit access to quality teaching materials.

Despite these issues, pioneering initiatives such as the National Endowment for Financial Education’s “High School Financial Planning Program” have demonstrated measurable improvements in students’ financial skills and attitudes, paving the way for nationwide adoption.

The Future of Financial Literacy Education: Opportunities and Innovations

Looking ahead, the role of financial literacy in schools is set to expand, leveraging technological advancements and evolving economic realities. Digital tools like budgeting apps, online investment simulators, and gamified financial learning platforms offer immersive, interactive methods to teach finance principles.

Artificial intelligence and adaptive learning can personalize financial education, ensuring that each student’s unique needs and knowledge gaps are addressed. Schools can integrate real-world data and scenarios, such as tracking actual stock market trends or managing simulated budgets that adjust based on economic conditions.

Furthermore, as cryptocurrencies and decentralized finance become more prevalent, curricula need to adapt, addressing emerging financial technologies and their risks. Preparing students for a rapidly changing financial world ensures they remain competent decision-makers.

On a policy level, governments and educational institutions must collaborate to create consistent national standards for financial literacy. This can help bridge disparities among regions and guarantee that all students, regardless of background, receive quality financial education.

Empowering the Next Generation for Financial Success

Financial literacy education is more than an academic subject; it is a fundamental life skill that impacts the well-being and security of individuals and communities. By embedding financial literacy in school systems, societies can foster responsible money management, reduce financial inequality, and contribute to economic stability.

The evidence is clear: students equipped with solid financial knowledge are better prepared to face economic challenges, avoid debilitating debt, and achieve financial independence. As the financial landscape grows increasingly complex, ensuring that all students have access to quality financial education is imperative.

By investing in innovative teaching methods, comprehensive curricula, and teacher training, schools can transform financial literacy from an overlooked topic into a cornerstone of lifelong success. This proactive approach will empower future generations to make informed financial decisions, supporting their personal goals and the broader economy for years to come.

Deixe um comentário