Tax havens have long been subjects of debate across international finance, law, and governance. These jurisdictions offer favorable tax regulations that attract individuals and corporations seeking to minimize their tax burdens. Understanding what tax havens are, how they function, and their broader impact on the global economy is essential for policymakers, businesses, and taxpayers worldwide.

Understanding Tax Havens: Definitions and Characteristics

A tax haven is a country or jurisdiction that provides minimal tax liability to foreign individuals and businesses, often coupled with stringent financial secrecy laws. Typically, these jurisdictions offer zero or very low corporate tax rates, lenient regulatory frameworks, and legal structures designed to protect confidentiality.

One of the most cited definitions comes from the Organization for Economic Cooperation and Development (OECD), which characterizes tax havens based on the absence of effective exchange of information, no or nominal taxes, and lack of substantial activities for companies registered there. Some well-known tax havens include the Cayman Islands, Bermuda, Luxembourg, and Panama.

For example, Luxembourg, while being a member of the EU and OECD, maintains favorable tax rulings that have attracted many multinational companies. The so-called “LuxLeaks” scandal in 2014 revealed how many corporations used secret agreements to drastically reduce their tax bills, showcasing how a tax haven functions beyond just zero-tax rates.

Mechanisms Behind Tax Havens: How They Operate

Tax havens operate through a combination of low or zero tax rates and secrecy provisions which obscure asset ownership and transaction details. These jurisdictions create an environment conducive to legal tax avoidance and, potentially, illegal tax evasion.

One common method involves the establishment of shell companies, which are entities that exist only on paper and conduct no actual business activities. Firms or wealthy individuals register these shells in tax havens to shift profits, intellectual property rights, or earnings away from higher-tax jurisdictions.

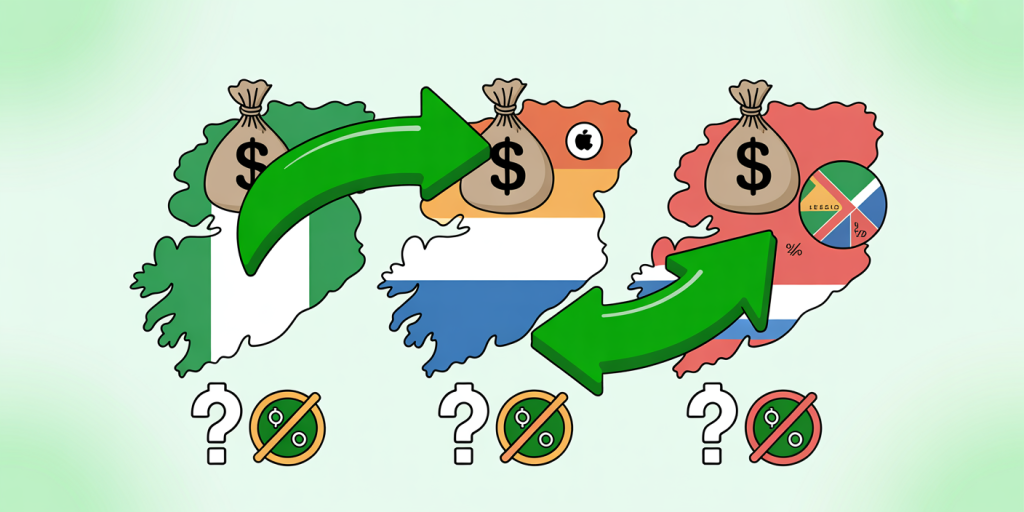

A notable example is the “Double Irish with a Dutch Sandwich” strategy historically used by tech giants like Google and Apple. This involved routing profits through Irish and Dutch subsidiaries, and finally to tax havens like Bermuda, effectively slashing their tax rates to near zero. While recent regulatory moves have limited this practice, it exemplifies how tax havens facilitate tax avoidance schemes.

The element of secrecy is equally crucial. Many tax havens refuse or delay sharing financial information with foreign tax authorities. The secrecy not only protects privacy but also makes it difficult for governments to track unreported income or assets.

Comparative Overview: Tax Havens vs. Non-Haven Jurisdictions

| Feature | Tax Havens | Non-Haven Jurisdictions |

|---|---|---|

| Corporate Tax Rate | Often 0% – 5% | Typically 15% – 40% |

| Financial Secrecy | High – limited financial disclosure requirements | Moderate to low – regular transparency |

| Regulatory Environment | Lenient, designed to attract foreign capital | Strict, focused on public accountability |

| Exchange of Information | Limited to none or delayed | Robust and immediate |

| Economic Substance Requirement | Often minimal or absent | Required, with compliance enforcement |

| Use Cases | Holding companies, asset protection, wealth management | Active business operations and employment |

This table highlights how tax havens’ lenient tax and regulatory regimes set them apart. While non-haven countries prioritize transparency and taxing economic activities, tax havens cater principally to entities looking for tax advantages without significant physical presence or genuine business operations.

The Global Impact of Tax Havens: Economic and Ethical Considerations

Tax havens have significant implications for global economies, often generating controversy. On one hand, they serve as hubs to facilitate capital flow, attract investment, and support globalized business strategies. On the other hand, they contribute to substantial tax revenue losses for countries, particularly developing nations.

According to a 2020 report by the Tax Justice Network, an estimated $427 billion in corporate tax revenue is lost worldwide annually due to tax avoidance facilitated by tax havens. This figure underscores the scale of the issue, exacerbating income inequality and reducing funds available for public services.

Developing countries are disproportionately affected as they rely more heavily on corporate tax revenue. In contrast, some small island nations choose to become tax havens as part of their economic strategy, generating revenue by attracting foreign capital instead of relying on traditional industries.

Ethically, tax havens raise questions about fairness and the social responsibility of corporations and wealthy individuals. The international uproar following the Panama Papers leak in 2016 exposed how the use of hidden offshore accounts enables corruption, money laundering, and illicit financial flows.

Regulation and International Cooperation: Efforts to Combat Tax Haven Abuse

In response to the challenges posed by tax havens, international organizations and governments have intensified efforts to increase transparency, share information, and close loopholes.

The OECD’s Base Erosion and Profit Shifting (BEPS) Project, launched in 2013, is among the most significant initiatives aiming to curb aggressive tax avoidance. BEPS recommendations include improving transfer pricing rules and requiring multinational enterprises to provide country-by-country reports on their profits, taxes, and economic activities.

Another important development is the Common Reporting Standard (CRS), adopted by over 100 jurisdictions, which facilitates the automatic exchange of financial account information. This has somewhat limited the financial secrecy traditionally offered by tax havens.

Despite progress, many tax havens remain reluctant or slow in fully complying with international standards. Some jurisdictions rebrand themselves or introduce new structures to maintain their attractiveness, illustrating the cat-and-mouse nature of tax regulation.

Real-World Cases: Lessons from Panama Papers and Paradise Papers

The Panama Papers (2016) and Paradise Papers (2017) scandals serve as landmark cases that unveiled the inner workings of tax havens on a global scale. These leaks from major offshore law firms and financial services providers disclosed thousands of offshore entities connected to politicians, celebrities, and businesses.

The Panama Papers revealed how Mossack Fonseca, a Panamanian law firm, helped clients evade taxes and launder money by setting up anonymous corporations. High-profile names surfaced, including heads of state and business tycoons, prompting investigations worldwide.

Similarly, the Paradise Papers exposed the offshore activities of multinational corporations such as Apple and Uber, highlighting how profit shifting remains prevalent despite regulatory advances.

These revelations spurred numerous reforms and increased scrutiny but also demonstrate the ongoing challenges in combating offshore tax avoidance.

Future Perspectives: Trends and Challenges in Tax Haven Regulation

Looking ahead, the landscape of tax havens is likely to evolve in response to political pressures and technological advances. Digital economy taxation is a growing area of concern as traditional tax rules struggle to capture profits generated by online activities.

The push for a global minimum corporate tax rate, spearheaded by the OECD’s Inclusive Framework since 2021, aims to impose a floor of at least 15% on the corporate tax rate for multinationals. This has already led some tax havens to reconsider their low-tax policies, potentially reshaping the competitive dynamics.

Blockchain technology and increased data analytics capabilities also provide tax authorities with new tools to detect and monitor suspicious financial flows, which could reduce the appeal of secrecy offered by tax havens.

However, challenges remain, including the sovereignty of tax havens and the complexity of international tax law harmonization. The ongoing balance between attracting investment and ensuring fair tax contribution will continue to define debates around tax havens.

In sum, tax havens are complex and multifaceted entities embedded in the global financial ecosystem. Their unique tax and legal environments facilitate various strategies to reduce tax liabilities, influencing economies worldwide. While efforts to regulate and bring transparency have seen progress, evolving business models and international politics will shape the future of tax haven utilization. Understanding these dynamics remains key to addressing the financial inequalities and governance challenges posed by tax havens.