Living debt-free has become an increasingly popular financial goal for many individuals and families. Amid rising consumer debt levels worldwide, achieving a debt-free lifestyle not only brings financial stability but also significantly improves mental well-being and long-term wealth creation. According to the Federal Reserve, as of 2023, total U.S. household debt surpassed $17 trillion, which includes mortgages, credit cards, student loans, and auto loans. This staggering number underscores the importance of adopting effective strategies for managing and eliminating debt.

Embarking on the road to debt freedom requires discipline, education, and a well-structured plan. This guide outlines practical steps and real-world examples proven to help individuals reduce and ultimately eradicate debt. By following these strategies, readers can gain financial control, reduce interest expenses, and increase disposable income for savings or investments.

—

Understanding Your Debt Landscape

Before taking any action, it’s crucial to obtain a clear picture of your current debt situation. Many people overlook how much they owe in total, which makes setting realistic repayment goals difficult. Begin by listing all your debts: credit cards, student loans, personal loans, mortgages, and any other forms of borrowed money. Include details such as outstanding balances, interest rates, minimum monthly payments, and repayment terms.

For example, Emily, a 29-year-old marketing professional, consolidated her debts into a detailed spreadsheet. She noted she owed $8,000 on credit cards at an average 18% APR, $15,000 in student loans at 6%, and $12,000 in a car loan at 5%. Understanding where the bulk of the interest was coming from allowed her to prioritize repayments and avoid targeting loans with lower interest rates first.

<figure> <table> <thead> <tr> <th>Debt Type</th> <th>Balance</th> <th>Interest Rate</th> <th>Minimum Monthly Payment</th> </tr> </thead> <tbody> <tr> <td>Credit Cards</td> <td>$8,000</td> <td>18%</td> <td>$320</td> </tr> <tr> <td>Student Loans</td> <td>$15,000</td> <td>6%</td> <td>$150</td> </tr> <tr> <td>Auto Loan</td> <td>$12,000</td> <td>5%</td> <td>$280</td> </tr> </tbody> </table> <figcaption>Table 1: Example Debt Profile</figcaption> </figure>

Documenting this information helps avoid confusion and allows for a targeted approach to repayment. Accuracy is vital — regularly checking statements and using budgeting apps like Mint or You Need a Budget (YNAB) can streamline this process.

—

Setting Realistic Goals and Budgets

Once your debts are laid out, set specific, time-bound goals. Instead of vague ambitions like “pay off my credit cards,” commit to measurable targets such as “reduce credit card debt by $1,500 over the next three months.” This makes monitoring progress more tangible and motivating.

Creating a budget is the foundation for these financial goals. A well-structured budget aligns your income with expenses, ensuring you allocate sufficient funds toward debt repayment. Start by categorizing expenses into fixed (rent, utilities) and variable (dining out, entertainment). Identify non-essential costs you can cut to free up extra cash for debt payments.

Take John and Lisa, a dual-income couple from Ohio, who spent $600 a month on dining and entertainment. By reducing this to $300 and cooking more at home, they redirected an additional $300 towards debt. Within 12 months, they cut $3,600 from their credit card balance, demonstrating the power of controlled spending.

—

Choosing the Right Debt Repayment Strategy

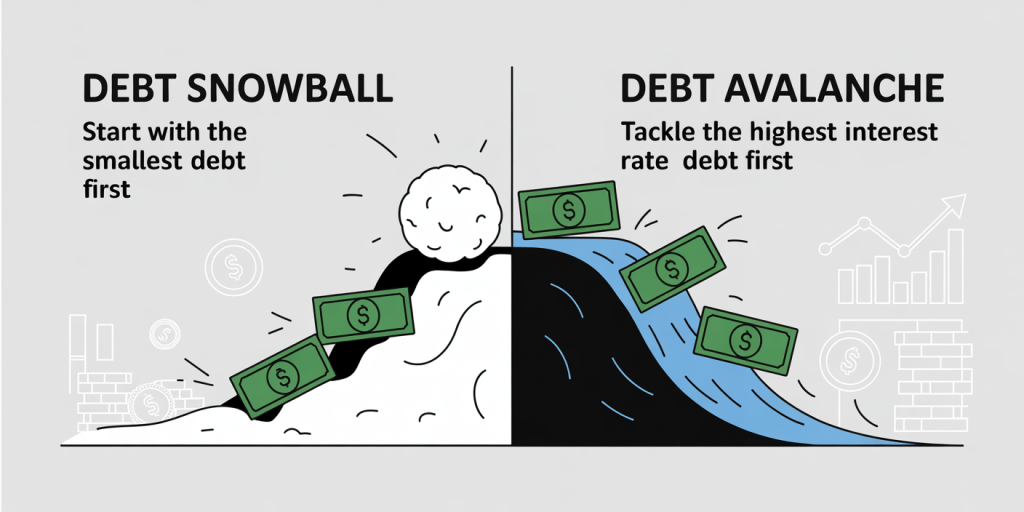

Several repayment methods exist, each with unique benefits. The two most popular approaches are the Debt Snowball and Debt Avalanche methods. Debt Snowball: Pay off the smallest balance first while making minimum payments on larger debts. This approach focuses on quick wins to build momentum. Debt Avalanche: Prioritize the highest interest rate debt first to minimize total interest paid over time.

Using the earlier example of Emily, applying the Debt Avalanche method allowed her to target the credit card debt (18% APR) first, saving her nearly $2,000 in interest compared to the Debt Snowball approach after two years.

<figure> <table> <thead> <tr> <th>Method</th> <th>Order of Repayment</th> <th>Advantages</th> <th>Typical Outcome</th> </tr> </thead> <tbody> <tr> <td>Debt Snowball</td> <td>Smallest to Largest</td> <td>Psychological motivation from quick payoff</td> <td>Longer total repayment period, potentially higher interest paid</td> </tr> <tr> <td>Debt Avalanche</td> <td>Highest Interest to Lowest</td> <td>Lower overall interest payments, faster total repayment</td> <td>Requires discipline, less immediate gratification</td> </tr> </tbody> </table> <figcaption>Table 2: Comparison of Repayment Strategies</figcaption> </figure>

For beginners who struggle with motivation, the Debt Snowball can improve adherence despite being less cost-effective. Conversely, the Debt Avalanche appeals to more financially analytical individuals who want to minimize interest expense.

—

Maximizing Income and Reducing Expenses

Increasing your monthly available cash accelerates your debt payoff timeline. This can be achieved by either generating additional income or decreasing spending.

Side hustles are a popular way to boost income without quitting your primary job. Freelance writing, ridesharing, tutoring, or selling handmade products online can generate hundreds or even thousands of extra dollars per month. Sarah, a graphic designer in California, earned an additional $700 monthly freelancing, which she dedicated 100% to student loan repayment. This boosted her payoff speed by 20%.

Simultaneously, cutting discretionary expenses helps free more money for debt reduction. Take the annual expense of subscription services — an average American subscribes to 5-6 services costing around $240 annually per person, according to Leichtman Research Group. Canceling unused subscriptions or negotiating better deals can recover a few extra dollars monthly without much sacrifice.

—

Consolidation and Refinancing as Tools for Debt Relief

For borrowers with multiple high-interest debts, consolidation or refinancing can simplify payments and lower interest rates. Debt consolidation involves combining several debts into a single loan with a fixed interest rate. This reduces the number of payments and often lowers monthly obligations.

For example, Michael combined $25,000 of credit card and personal loan debt into a 5-year personal loan at a 9% interest rate, compared to weighted average of 18% on his prior debts. His monthly payment went down from $900 to $650, easing monthly budgeting and improving cash flow.

Refinancing, especially for student loans and mortgages, works similarly by renegotiating loan terms for better rates. Keep in mind, however, refinancing can sometimes extend the repayment term, which might increase total interest costs despite lowering monthly payments.

Before pursuing these options, assess fees, penalties, and eligibility criteria. Using online calculators or discussing with a financial advisor can clarify whether consolidation or refinancing aligns with your debt-free timeline.

—

Cultivating Debt-Free Habits for the Long Term

Achieving debt freedom is a milestone, but sustaining it requires ongoing vigilance and healthy financial habits. Track your budget monthly, avoid impulsive purchases, and maintain an emergency fund of at least 3-6 months of living expenses to prevent accruing new debt during unexpected situations.

Financial literacy plays a key role in long-term success. Empower yourself by reading books like “The Total Money Makeover” by Dave Ramsey or following financially savvy podcasts and blogs. Knowledge will help you make informed choices like investing early, understanding credit scores, and recognizing good debt vs. bad debt.

Real-life examples show that maintaining debt-free status is possible. For instance, after paying off her $40,000 student loan, Anna automated her monthly savings contributions to build wealth instead of returning to credit card use. She credits discipline and education for breaking the cycle of debt.

—

Looking Ahead: The Future of Debt Management and Financial Freedom

As technology advances, managing debt is becoming more accessible and tailored through digital platforms. AI-driven budgeting apps now offer personalized advice, while lenders are increasingly providing options for flexible repayment plans. Moreover, the rise of financial wellness programs at workplaces supports employees in reducing debt responsibly.

Economic fluctuations also impact debt management strategies. Inflation, interest rate changes, or unexpected job market dynamics require flexibility and continual reassessment of financial plans. Building resilience, including diversifying income streams and strengthening credit profiles, will be vital.

Importantly, the concept of debt itself might evolve. Emerging philosophies encourage minimalism, prioritizing financial independence over consumerism. Early retirement movements like FIRE (Financial Independence, Retire Early) illustrate widespread interest in breaking free sooner from the debt cycle, focusing on frugality, saving, and smart investment.

By remaining proactive, informed, and adaptable, individuals can not only eliminate debt but also harness financial freedom as a platform for life goals and security.

—

Living debt-free is not only about eliminating monthly payments; it is about reclaiming control over your financial future. Through understanding your debt, setting realistic and measurable goals, using effective repayment strategies, and cultivating sound financial habits, anyone can build a foundation for sustained economic well-being. As you embark on this journey, remember that persistence, education, and strategic planning are your greatest allies towards a debt-free life.

Deixe um comentário