In today’s fast-paced and complex economic environment, financial literacy has become an essential life skill, especially for teenagers preparing to navigate adulthood. Understanding the basics of money management, budgeting, saving, investing, and credit can provide young people with the tools they need to make informed decisions, avoid debt traps, and build long-term wealth. According to a 2018 survey by the National Endowment for Financial Education (NEFE), only 17 states in the USA require high school students to take a personal finance course before graduation, highlighting a critical gap in financial education.

As teens start earning allowances, part-time job incomes, or gifts, financial literacy empowers them to manage these resources wisely. By embedding financial education early, teens build confidence in handling their finances and develop habits that significantly influence their financial well-being as adults. This article explores key components of financial literacy tailored for teens, practical examples, data-backed insights, and future perspectives on enhancing financial education.

Understanding Basic Money Management Skills

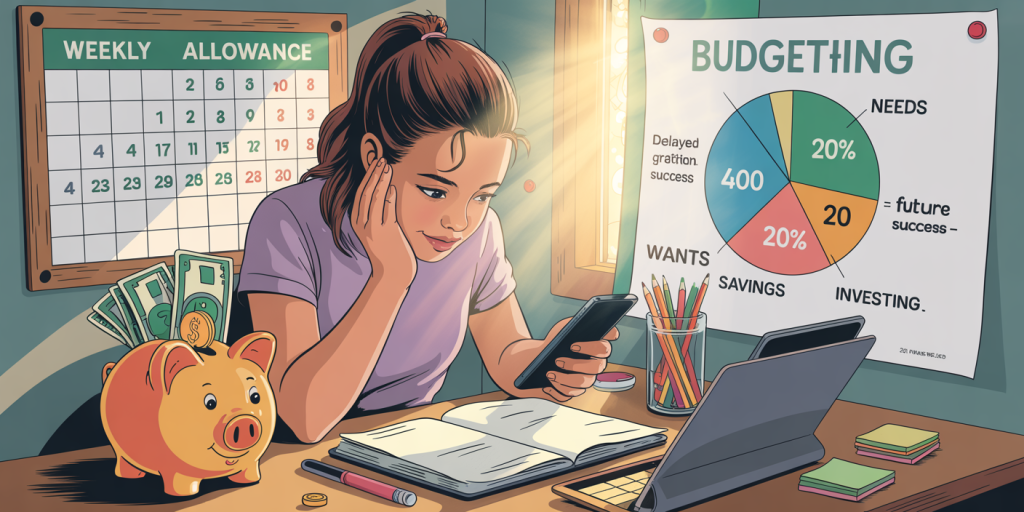

At the core of financial literacy lies the ability to manage money effectively. This means knowing how to balance income with expenses, keep track of spending, and plan for future liquidity needs. For many teens, basic money management starts with an allowance or earnings from part-time jobs.

One common practical example is creating a simple budget. A teen earning $100 weekly from part-time work might allocate funds as follows: 40% savings ($40), 30% spending ($30), 20% bills or necessities ($20), and 10% for charity or gifts ($10). This approach, based on the tried-and-tested 40-30-20-10 rule, teaches valuable lessons about prioritizing expenses.

According to a study by the Jump$tart Coalition for Personal Financial Literacy, teens who budget their money are 33% more likely to save regularly as adults. Financial apps like Mint or PiggyBot, designed for young users, have simplified this process by automating tracking and goal-setting.

Practical Example: Budgeting for a Teen’s First Smartphone

A practical case is when a teen wants to buy an expensive item, such as a smartphone costing $600. By budgeting a portion of weekly income and cutting discretionary spending, the teen can reach the goal without incurring debt. For instance, saving $50 a week results in $600 in 12 weeks. This teaches delayed gratification and goal-oriented saving strategies.

The Importance of Saving and Investing Early

Saving money is often the first step toward financial stability. However, nearly 60% of young Americans report having no savings at all when they enter college or leave high school, as per a Harris Poll (2020). Early saving habits, even with small amounts, contribute to long-term wealth creation.

Investment knowledge is another critical area that often gets overlooked among teens. Introducing teens to basic investment concepts like stocks, bonds, and mutual funds encourages them to think about growing their money, rather than just saving it. For example, a teen who invests $100 monthly starting at age 16 in a diversified stock portfolio averaging 7% annual returns could have over $170,000 by age 65, compared to $35,000 saved without investment growth.

Saving vs. Investing: Comparative Table for Teens

| Aspect | Saving | Investing |

|---|---|---|

| Primary Goal | Preserve money for short-term needs | Grow money for long-term wealth |

| Risk Level | Very low | Varies (low to high) |

| Accessibility | High (easy to withdraw) | Variable (depends on investment) |

| Expected Returns | 0-2% (savings accounts) | 5-8% or more (stocks, funds) |

| Ideal Time Horizon | Short-term (<1 year) | Medium to long-term (>5 years) |

| Example Tools | Savings accounts, piggy banks | Stock market, mutual funds |

Financial literacy programs like the National Financial Educators Council (NFEC) emphasize incorporating investment fundamentals early to foster a mindset geared toward wealth accumulation rather than mere survival.

Understanding Credit and Debt Management

Credit plays a significant role in the financial lives of adults, and understanding how to use it responsibly is crucial. Unfortunately, statistics show that by the age of 30, the average American carries over $90,000 in debt, including mortgages, student loans, and credit card balances (Federal Reserve, 2022). Teaching teens about credit cards, interest rates, and the dangers of overspending can prevent them from falling into debt traps.

A practical example is discussing credit card use. Suppose a teen receives a secured credit card with a $500 limit to build credit history. If they only spend $100 monthly and pay off the full amount on time, they establish good credit and avoid interest. However, failing to pay the balance leads to interest charges, often above 20%, causing debt to grow quickly.

Real cases highlight the consequences of poor credit management. The Consumer Financial Protection Bureau (CFPB) revealed that approximately 26% of young adults aged 18-24 had a negative credit event such as a missed payment or delinquency in 2019, affecting their ability to obtain loans or rent apartments.

Daily Financial Decisions: Needs vs. Wants

Teens often face situations where they must evaluate what expenditures are necessary versus discretionary. This decision-making process sharpens financial discipline and inculcates mindful spending habits.

For example, a teen deciding between buying a $5 coffee daily or brewing coffee at home can save roughly $25-$30 weekly or around $1,200 annually. When compared over multiple years, these small savings become material. Developing the habit of differentiating needs from wants is reinforced through family discussions, financial education workshops, and personal reflection.

Moreover, behavior economics studies demonstrate that peer influence heavily impacts teen spending. Programs incorporating group activities and real-world simulations tend to be more effective in aligning teen spending with financial goals.

The Role of Technology in Teen Financial Education

Technology has transformed the way teens engage with personal finance. Mobile banking, budgeting apps, digital wallets, and online investment platforms are accessible even to young audiences. According to a study by Common Sense Media (2023), 85% of teens use smartphones daily, making digital tools a powerful medium for financial education.

Apps such as Greenlight and Step provide debit cards with parental controls for teens, enabling hands-on money management experience while keeping parents informed. Gamified financial literacy apps introduce concepts like compound interest and credit scores interactively, increasing engagement.

Case in point: a study involving a gamified finance app reported a 27% increase in teens’ financial knowledge after three months of use. This approach aligns with the millennials’ and Gen Z’s preference for technology-based learning, making financial literacy accessible and enjoyable.

Preparing Teens for Financial Independence: Future Perspectives

The need to enhance financial literacy among teens is gaining traction globally. Governments, schools, and nonprofits are progressively integrating financial education into curriculums. Research by the Organisation for Economic Co-operation and Development (OECD) indicated countries with mandatory financial education see improved savings rates and reduced debt levels in young populations.

Looking ahead, financial literacy programs for teens will likely become more personalized, leveraging artificial intelligence to tailor lessons based on individual behavior and needs. Virtual reality (VR) simulations might recreate real-life financial scenarios, giving teens practical experience without real-world risk.

Moreover, as cryptocurrencies and decentralized finance (DeFi) gain prominence, upcoming financial education must evolve. Teaching teens the fundamentals of blockchain, digital wallets, and the risks of speculative investing will be essential.

There’s also a growing emphasis on holistic financial wellness, which includes emotional and psychological aspects of money management. Programs incorporating behavioral finance principles aim to empower teens to make better choices by understanding their biases and motivations.

Collaborations between financial institutions, ed-tech startups, and educational authorities could lead to enriched content, more access, and broader impact. For instance, initiatives like the “Money Smart” program by the FDIC have demonstrated success in reaching diverse youth populations with tailored content.

Final Thoughts on Financial Literacy for Teens

Equipping teens with robust financial skills is an investment in their future stability and prosperity. Early education not only reduces the risk of financial mistakes but also fosters confidence, independence, and the ability to adapt to economic shifts. By embracing technology, practical approaches, and mentorship, society can empower the next generation to build a secure financial future with knowledge and responsibility.

Deixe um comentário