Commodities have long been an essential component of investment portfolios, offering diversification and inflation protection. With the global economy’s continuous evolution, interest in commodities such as gold, oil, and other raw materials is resurging among both institutional and retail investors. Understanding the opportunities, risks, and mechanisms of investing in these tangible assets is crucial for those seeking to enhance their portfolios beyond traditional stocks and bonds.

Commodities are physical goods that underpin the functioning of economies worldwide. From precious metals to energy products and agricultural goods, these assets often respond differently to market forces compared to financial instruments. Their prices are driven by supply and demand variables, geopolitical tensions, and macroeconomic trends. This article delves deeply into the core aspects of investing in commodities, focusing on gold, oil, and alternative options, providing practical insights supported by data and real-world cases.

The Role of Gold in Investment Portfolios

Gold holds a unique place as both a store of value and a hedge against economic uncertainty. Traditionally regarded as a “safe haven” asset, gold’s price movements are often counter-cyclical to stock markets. For example, during the COVID-19 pandemic onset in March 2020, gold prices soared by approximately 15% in just a few months as investors sought stability amidst market turmoil.

One fundamental reason for gold’s appeal is its historical reliability in preserving purchasing power. Unlike fiat currencies, gold is a finite resource, with total above-ground reserves estimated at around 201,000 metric tons, according to the World Gold Council. Investors can gain exposure to gold through various channels including physical bullion, gold ETFs, futures contracts, and mining stocks.

Practical cases highlight gold’s effectiveness during inflationary periods. From 2020 to 2022, when U.S. inflation rates reached multi-decade highs—peaking at 9.1% in June 2022—the price of gold rose approximately 12%, underscoring its role in hedging purchasing power erosion. However, investors should consider that gold does not generate cash flows or dividends, which may impact long-term returns compared to equities.

Oil: Energy Market Dynamics and Investment Considerations

Oil is arguably the most critical commodity in the global economy, driving transportation, manufacturing, and energy production. The price movements of crude oil respond to a complex set of factors including geopolitical events, OPEC policies, technological advancements, and global demand shifts. The Brent crude benchmark price fluctuates daily and has ranged historically from below $20 per barrel during the 2020 pandemic lows to above $120 per barrel during supply constrictions and geopolitical disruptions.

Investing in oil can be done through direct futures contracts, energy-focused ETFs, stocks of oil majors like ExxonMobil or Royal Dutch Shell, and mutual funds. Each method carries unique risk profiles. For example, futures trading requires advanced market understanding due to leverage and contango/backwardation phenomena.

A real-world example is the 2020 oil price crash—the first-ever plunge of U.S. crude futures into negative territory. This unprecedented event was caused by plummeting demand amidst COVID-19 lockdowns and constrained storage capacity. Investors exposed to short-term futures without proper risk management faced significant losses, emphasizing the need for strategic approaches when investing in oil.

Investors may also consider integrated energy companies over direct commodity exposure for more stable returns, as these companies combine exploration, refining, and distribution, buffering volatility.

Beyond Gold and Oil: Alternative Commodities for Diversification

While gold and oil dominate commodity investments, other commodities such as agricultural products (wheat, corn, coffee), industrial metals (copper, aluminum), and rare earth elements merit attention. These assets often react differently to economic cycles and supply constraints, offering potential diversification benefits.

For example, copper, dubbed “Dr. Copper” by market analysts, serves as a barometer of global economic health due to its extensive use in construction and manufacturing. During the global recovery post-2008 financial crisis, copper prices surged from approximately $2,000 per metric ton in 2009 to over $10,000 by 2011, reflecting robust industrial demand.

Agricultural commodities respond to weather patterns, geopolitical tensions, and changing consumption trends. For instance, the Russia-Ukraine conflict in 2022 significantly disrupted wheat exports, leading to price spikes over 50%. Investors with stakes in agricultural commodity ETFs witnessed gains amid supply concerns.

Rare earth metals have gained prominence due to their critical role in renewable energy technologies and electronics, with China controlling approximately 60% of global production. Supply chain risks and increasing demand suggest investment potential, especially in mining firms and commodity-linked funds.

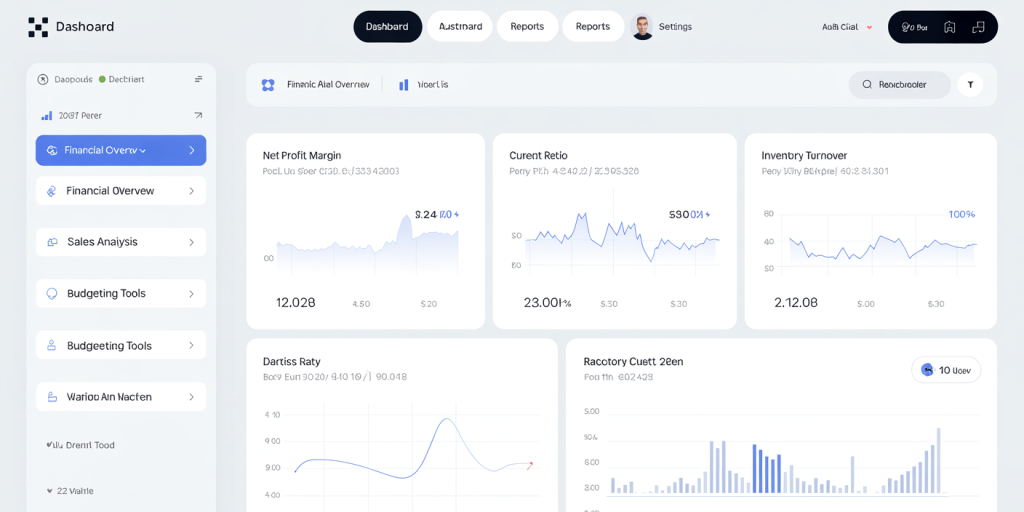

| Commodity | Primary Drivers | Price Volatility (5-year avg) | Example ETFs / Investment Vehicles |

|---|---|---|---|

| Gold | Inflation, geopolitical risk | Moderate | SPDR Gold Shares (GLD), Physical bullion |

| Oil (Brent Crude) | Supply shocks, demand fluctuations | High | United States Oil Fund (USO), ExxonMobil |

| Copper | Industrial demand, economic growth | Moderate-High | Global X Copper Miners ETF (COPX) |

| Wheat | Weather, geopolitics | High | Teucrium Wheat Fund (WEAT) |

| Rare Earth Metals | Tech demand, supply constraints | Moderate | VanEck Rare Earth/Strategic Metals ETF (REMX) |

This table provides a comparative snapshot of commodity characteristics that investors should analyze in portfolio allocation decisions.

Risks and Rewards of Commodity Investing

Investing in commodities presents both opportunities and challenges. On the upside, commodities offer protection against inflation and currency depreciation; they also provide diversification as their price movements often have low correlation with traditional asset classes.

The 1970s offer a historical lesson where commodities surged dramatically during stagflation, preserving wealth for many investors. Similarly, during periods of geopolitical unrest or financial system uncertainty, commodities tend to outperform.

However, commodities are subject to high price volatility influenced by unpredictable external events like natural disasters, regulatory changes, or technological disruptions. For instance, shale oil breakthroughs in the U.S. drastically altered global oil supply dynamics in the 2010s, leading to oversupply and price dips.

Another risk is the complexity of direct commodity ownership. Physical storage, transportation costs, and quality considerations add operational hurdles. Futures contracts carry risks of margin calls and roll yield losses in contango markets, potentially eroding returns. Additionally, commodity investing generally offers no income or dividends, thus relying on price appreciation alone.

Therefore, investors need carefully constructed strategies suited to their risk tolerance, investment horizon, and knowledge levels.

Strategies for Investing in Commodities

There are multiple routes to invest in commodities, each fitting different investor profiles. Physical ownership involves purchasing bullion or commodity stockpiles, appealing largely to those valuing tangible assets and long-term protection. For example, many central banks hold gold reserves as part of monetary policy buffers.

Futures contracts provide direct exposure to commodity price movements and are favored by speculative traders and institutions. However, retail investors can face challenges due to the need for margin and high volatility.

Exchange-traded funds (ETFs) provide diversification and ease of access. ETFs tracking gold (GLD) or oil (USO) allow investment without dealing with physical assets or complex futures markets. Similarly, commodity mutual funds or closed-end funds offer actively managed approaches.

Investing in commodity producer shares such as mining or oil companies is another strategy. These stocks often offer dividends and benefit from operational leverage when commodity prices rise. For instance, the five-year return of major gold miners like Barrick Gold exceeded that of gold bullion in certain periods, partly due to management efficiencies.

Hybrid approaches combining these methods can balance risk and reward. Dynamic portfolio allocation, guided by macroeconomic indicators and technical analysis, can enhance outcomes.

Future Perspectives on Commodity Investments

Looking ahead, commodities will continue playing a pivotal role in diversified investment portfolios. Global trends such as decarbonization, technological innovation, and geopolitical realignments will reshape commodity demand and supply.

The transition to renewable energy sources is likely to influence fossil fuel demand patterns, potentially reducing oil’s long-term dominance. Conversely, metals like lithium, cobalt, and nickel—essential for electric vehicle (EV) batteries—are expected to see soaring demand. According to BloombergNEF projections, EV sales could exceed 45% of new car sales globally by 2030, directly boosting demand for these commodities.

Climate change may increase agricultural commodity price volatility via unpredictable weather events, making strategic investment in these sectors prudent. Additionally, sustainable investing trends are pressuring miners and producers to adopt ESG-friendly practices, leading to the emergence of green commodity funds.

Digitalization and blockchain technology might improve commodity trading transparency and efficiency, reducing counterparty risks. Commodities linked to water and carbon credits could also gain investor attention as environmental concerns intensify.

In summary, commodities represent a dynamic, multifaceted asset class that adapts continuously to global economic shifts. Investors who develop a nuanced understanding of individual commodities, market drivers, and investment vehicles can capitalize on these trends while managing risks effectively.

—

References: World Gold Council, “Gold Demand Trends,” 2023. U.S. Energy Information Administration (EIA), “Petroleum & Other Liquids Data,” 2024. BloombergNEF, “Electric Vehicle Outlook 2023.” Teucrium, “Agricultural Commodity ETF Data,” 2024. VanEck, “Rare Earth/Strategic Metals ETF Factsheet,” 2023.