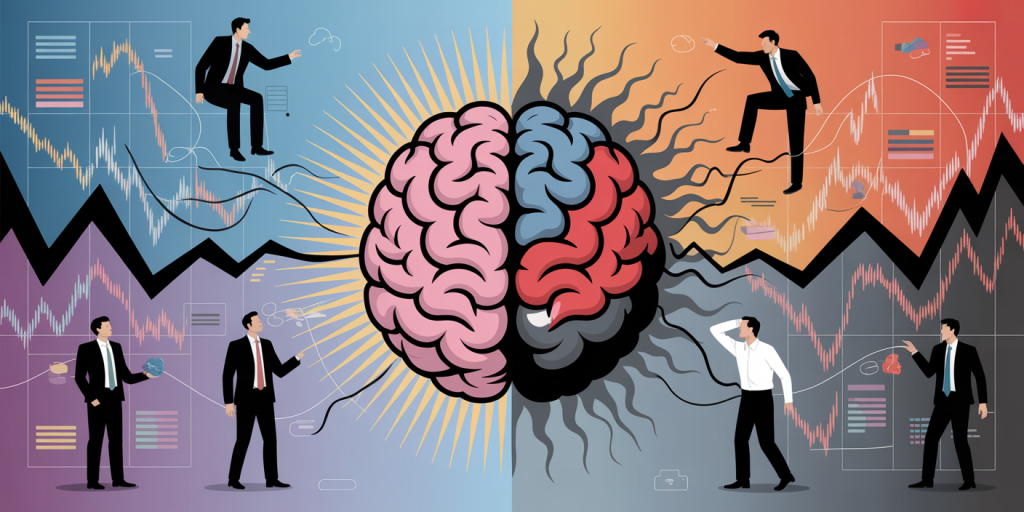

Financial decision-making is a complex process affected by various emotional and psychological factors, among which fear stands out as one of the most powerful influencers. Fear often drives individuals to avoid risks, make impulsive choices, or freeze their financial progress altogether. Understanding how fear shapes financial behavior enables more informed decision-making and helps individuals build resilience amid market volatility and economic uncertainty. This article delves into the psychological mechanisms behind fear in finance, explores common scenarios where fear skews decisions, and provides actionable insights to mitigate its adverse effects.

The Psychology Behind Fear and Money

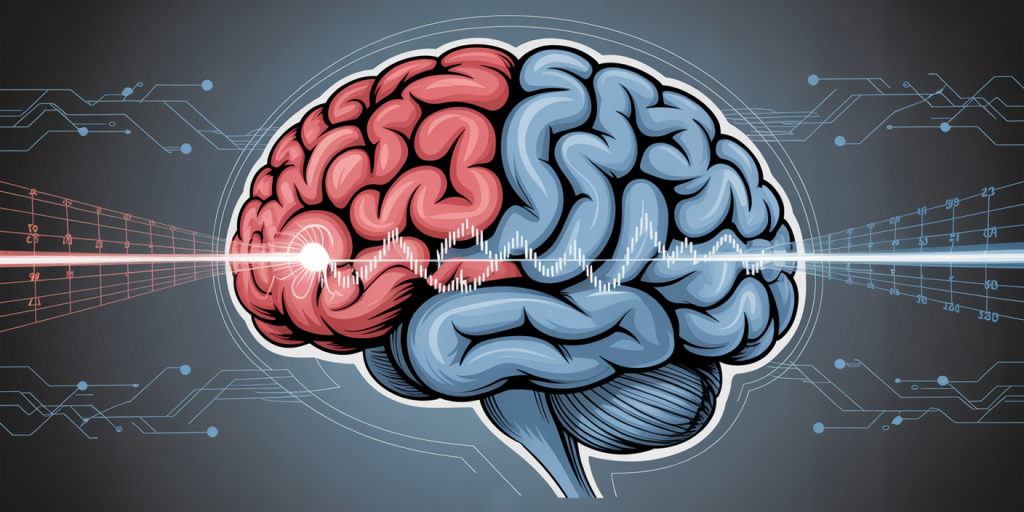

Fear is an evolutionary survival tool designed to protect individuals from harm, but in the context of finance, it can lead to irrational behavior. Neuroscience reveals that fear activates the amygdala, the brain’s emotional center, often overriding the prefrontal cortex responsible for reasoned thinking. When confronted with financial uncertainty, this response can cause individuals to prioritize short-term safety over long-term growth, leading to suboptimal financial outcomes.

For example, during volatile market conditions, investors often panic-sell assets to avoid losses. The 2008 financial crisis highlighted how widespread fear led to a massive sell-off, dramatically plunging stock market values worldwide. Studies from the Journal of Behavioral Finance indicate that approximately 80% of investors sell during drawdowns, locking in losses due to fear-driven decisions instead of waiting for market recovery.

How Fear Drives Risk Aversion in Investments

One of the most direct ways fear influences financial decisions is through increased risk aversion. Individuals overwhelmed by the potential for loss may avoid investment vehicles with higher returns because they also carry higher uncertainty. While this risk aversion may provide a temporary sense of security, it can significantly hinder the ability to accumulate wealth over time, especially in a low-interest-rate environment where conservative investments underperform inflation.

Consider the case of Jane and Mark, two investors with similar incomes but differing risk tolerances. Jane, fearful of market fluctuations, sticks exclusively to government bonds and savings accounts yielding approximately 2%-3% annually. In contrast, Mark allocates 60% of his portfolio to equities and mutual funds, accepting short-term fluctuations for higher long-term gains. Over 20 years, assuming an average equity return of 7%, Mark’s portfolio significantly outpaces Jane’s, illustrating how fear-driven risk aversion limits financial potential.

| Aspect | Jane (Fearful Investor) | Mark (Risk-tolerant Investor) |

|---|---|---|

| Asset allocation | 100% conservative | 60% equities, 40% bonds |

| Average annual return | 2.5% | 6.5% |

| Portfolio growth (20 years) | $100,000 → $163,865 | $100,000 → $349,491 |

Data sources: Historical returns based on S&P 500 average and U.S. Treasury bonds.

Fear-Induced Spending and Its Financial Impacts

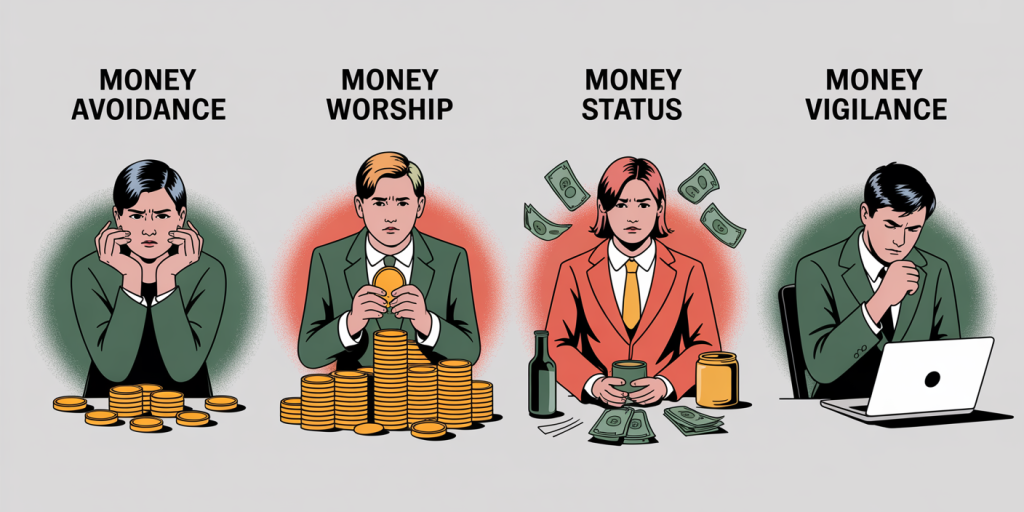

Fear does not only impact investing but also influences daily spending patterns. Financial anxiety often prompts either hoarding money amid uncertainty or compulsive spending as a coping mechanism. For some individuals, fear of future financial hardship leads to extreme frugality, potentially neglecting necessary investments in education, healthcare, or home improvements. Others fall into “retail therapy” driven by emotional distress, leading to accumulating debt.

A survey by the American Psychological Association in 2023 found that nearly 40% of respondents admitted to making impulsive purchases during times of financial stress. Conversely, a Gallup poll revealed that 25% of Americans deliberately cut back on essential spending due to fear of economic downturn, resulting in missed opportunities for wealth preservation. Both extremes have detrimental effects on long-term financial health, underscoring the importance of balanced financial planning that acknowledges emotional responses.

Real-World Example: Fear during the COVID-19 Pandemic

The COVID-19 pandemic created unprecedented uncertainty and fear worldwide, drastically impacting financial decisions on personal and institutional levels. According to a report by Deloitte, 62% of households reduced discretionary spending during the early months of the pandemic, reflecting fear of job loss and economic instability. Simultaneously, stock markets experienced extreme volatility, leading many investors to panic-sell or conversely, avoid investing altogether.

Tesla CEO Elon Musk highlighted this fear-driven behavior publicly, noting how the volatility made investors irrationally anxious, preventing them from capitalizing on buying opportunities. However, some investors who remained calm and invested during the market dip garnered significant returns as markets rebounded sharply post-pandemic peak fear. This case exemplifies how fear influences the timing and quality of financial decisions.

Techniques to Manage Fear in Financial Planning

Effectively managing fear requires a blend of psychological insight and practical strategy. One helpful approach is diversification, which reduces portfolio risk and creates a buffer against market shocks. Allocating funds across asset classes, industries, and geographic regions can minimize the fear of catastrophic losses.

Additionally, setting clear financial goals and adhering to a disciplined investment strategy reinforces confidence during uncertain times. Automated investment plans, such as dollar-cost averaging, reduce the temptation to time the market driven by fear, promoting consistent market participation regardless of fluctuations. Behavioral finance experts also advocate for mindfulness practices and professional financial advising to help curb emotional reactions.

Below is a comparative table of common strategies to manage fear alongside their benefits and drawbacks:

| Strategy | Benefits | Drawbacks |

|---|---|---|

| Diversification | Lowers risk, stabilizes returns | May limit upside in bullish markets |

| Dollar-cost averaging | Reduces timing risk, promotes discipline | May underperform lump-sum investment in rising markets |

| Financial education | Increases confidence, reduces anxiety | Requires time and effort |

| Professional financial advice | Tailored strategies, emotional support | Costs and potential conflicts of interest |

Future Perspectives: Overcoming Fear for Financial Empowerment

The future of personal finance lies in integrating behavioral understanding with technology and education to mitigate fear’s adverse effects. Advances in artificial intelligence and robo-advisors offer personalized, emotion-free investment management that can reduce fear-induced errors. Moreover, widespread financial literacy initiatives could empower individuals to recognize fear-driven biases and adopt rational approaches to money management.

Psychologists and financial planners predict that as societal awareness of mental health grows, emotional resilience will become as critical as technical knowledge in financial decision-making. Emerging trends, such as gamified financial education platforms and AI-driven coaching apps, are poised to help users practice calm and calculated financial behaviors, even during crises. Ultimately, conquering fear will lead not only to improved financial outcomes but also to enhanced overall well-being.

—

By understanding how fear influences financial decisions, individuals can take proactive measures to avoid costly mistakes driven by emotion. Awareness, disciplined strategy, and leveraging technology form the pillars of sound financial management, enabling sustained growth despite the inevitability of fear and uncertainty.