The stock market has long been heralded as one of the most effective ways to build wealth and secure financial freedom. For beginners, however, the labyrinth of stocks, indices, trading platforms, and investment jargon can seem intimidating and complex. Yet, understanding the basics and developing a disciplined approach can significantly increase your chances of success. This article aims to break down essential concepts, practical strategies, and real-world examples that can empower any novice investor to make informed decisions in the stock market.

With global stock markets valued at over $100 trillion as of 2023 (Statista, 2023), more individuals are recognizing the market’s potential. The transition from mere savings to investing in stocks enables people to leverage the power of compounding and capital appreciation over time. This beginner-friendly guide will cover the basic principles of stock investing, types of stocks, strategies to minimize risk, and how to utilize resources for sustained growth.

—

Understanding the Stock Market Fundamentals

Investing in stocks means purchasing shares of ownership in publicly traded companies. When you buy a stock, you essentially become a partial owner, entitled to a portion of the company’s profits and assets. Stocks are traded on stock exchanges like the New York Stock Exchange (NYSE) or Nasdaq, which facilitate buying and selling of shares in real time.

One practical example is Apple Inc., whose stock symbol is AAPL. If you buy 10 shares of AAPL, you own a portion of Apple. Over time, if Apple’s market value increases from a share price of $150 to $180, your investment appreciates accordingly. Additionally, if Apple pays dividends—portion of earnings distributed to shareholders—you receive regular income. Understanding these basics helps beginners grasp the dual benefit of capital appreciation and passive income inherent in stock ownership.

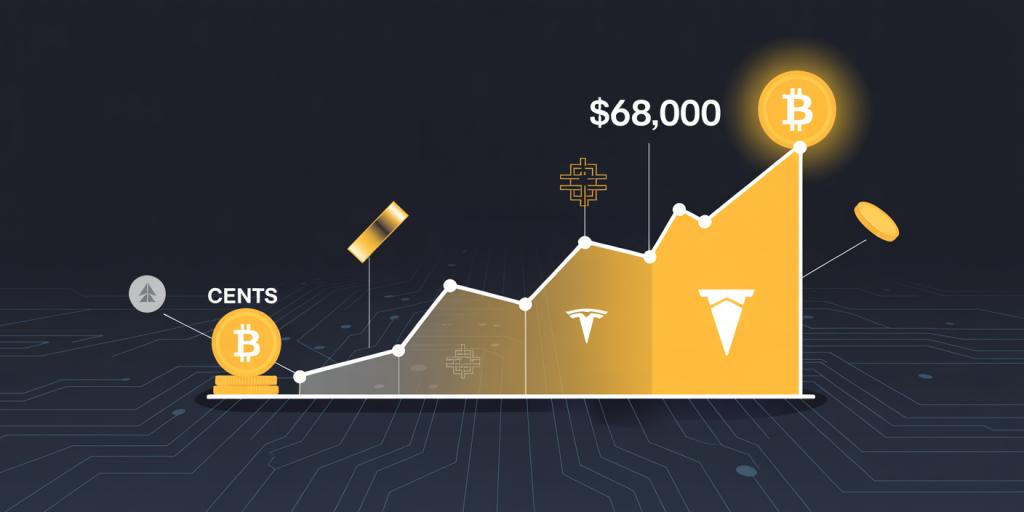

Stock prices fluctuate due to many factors including company performance, economic data, geopolitical events, and market sentiment. For instance, during the COVID-19 pandemic in early 2020, global stock markets plummeted nearly 30% due to uncertainty and economic shutdowns. However, by late 2020 and 2021, markets rebounded strongly, particularly in tech stocks like Amazon and Tesla, highlighting the opportunities for investors who understand market cycles. Those new to investing should recognize that volatility is natural and long-term perspective is key.

—

Types of Stocks and Their Characteristics

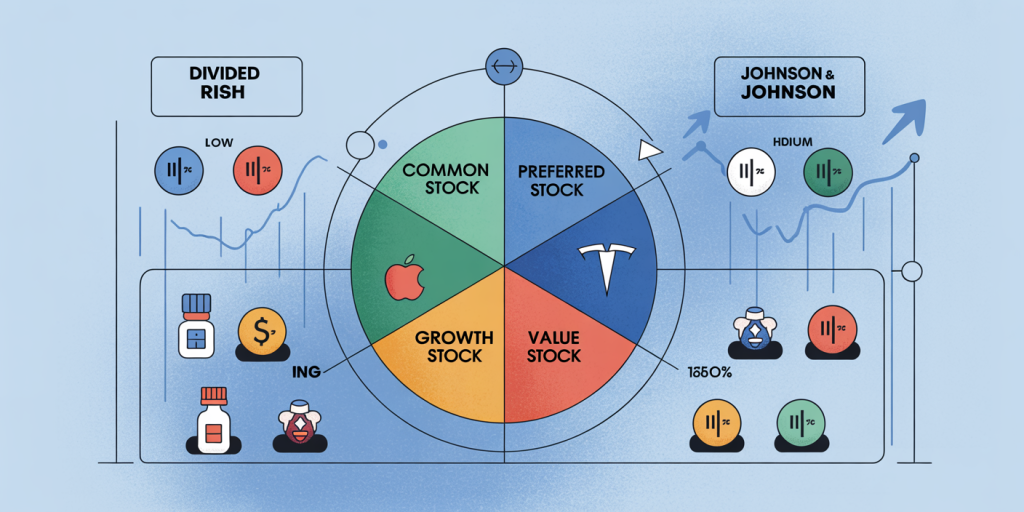

Stocks generally fall into two broad categories: common stocks and preferred stocks. Common stocks give shareholders voting rights and potential dividends but come with higher risk. Preferred stocks typically do not offer voting rights but provide fixed dividends, making them more stable but with limited upside.

Another important classification is between growth stocks and value stocks. Growth stocks, such as Tesla or Nvidia, focus on capital appreciation by reinvesting earnings into expansion and innovation. These stocks often do not pay dividends but have high price volatility. Value stocks, like Johnson & Johnson or Procter & Gamble, tend to be more stable and undervalued relative to their fundamentals, often paying consistent dividends.

| Stock Type | Characteristics | Risk Level | Income Potential | Example Company |

|---|---|---|---|---|

| Common Stock | Voting rights, growth & dividends potential | Moderate-High | Variable | Apple (AAPL) |

| Preferred Stock | Fixed dividends, no voting rights | Moderate | Fixed | Bank of America (Preferred shares) |

| Growth Stock | Reinvest earnings, high capital growth focus | High | Low/None | Tesla (TSLA) |

| Value Stock | Undervalued, pays dividends | Moderate | High | Johnson & Johnson (JNJ) |

Understanding these distinctions helps beginners build a diversified portfolio that balances risk and reward according to their goals and risk tolerance.

—

Strategies for Minimizing Risk in Stock Investing

Stock market investing inherently carries risk, but adopting the right strategies can significantly reduce potential losses. Diversification is one of the fundamental approaches. By spreading investments across different sectors, geographic areas, and asset classes, investors can minimize the impact of a downturn in any single stock or sector.

For example, an investor holding stocks in the technology sector might also invest in healthcare, utilities, and consumer goods. Historically, during the 2008 financial crisis, stocks in utilities and consumer staples were more resilient compared to financial stocks, underscoring the value of sector diversification.

Another practical strategy is dollar-cost averaging (DCA), where investors buy a fixed dollar amount of stock at regular intervals regardless of the share price. This method reduces the risk of market timing by smoothing out purchase prices over time. For instance, instead of investing a lump sum of $12,000 in one go, spreading it into monthly investments of $1,000 reduces exposure to sudden market dips.

Risk management also involves setting stop-loss orders, which automatically sell a stock if its price drops below a certain threshold, thus limiting losses. A beginner investor might place a stop-loss order at 10% below the purchase price to protect their principal while allowing some room for market fluctuations.

—

How to Choose Stocks for Your Portfolio

Selecting stocks requires a mix of qualitative and quantitative analysis. Beginners can begin with fundamental analysis, which involves evaluating a company’s financial health, earnings growth potential, competitive position, and management quality.

Key metrics to consider include Price-to-Earnings (P/E) ratio, Earnings Per Share (EPS), Dividend Yield, and Return on Equity (ROE). For instance, a company with a P/E ratio significantly higher than its industry peers might be overvalued, whereas a very low P/E could indicate undervaluation or financial troubles. Take Coca-Cola (KO), a classic value stock with a stable dividend yield around 3%, which appeals to conservative investors.

Technical analysis, which focuses on chart patterns and trading volumes, can also help investors identify entry and exit points. Beginners should proceed cautiously with technical indicators until gaining sufficient experience.

An example of stock selection would be analyzing Microsoft (MSFT). It has consistently shown strong revenue growth, a P/E ratio near the industry average, diversified product lines, and robust cash flow. This signals a stable and potentially profitable investment.

—

Leveraging Technology and Tools for Stock Investing

Modern technology has made stock investing accessible to virtually everyone. Online brokerage platforms such as Fidelity, Charles Schwab, and Robinhood provide user-friendly interfaces, educational resources, and low or zero commissions. Many also offer virtual trading simulators to practice investing without risking real money.

Additionally, investors can use financial news portals like Bloomberg or Reuters, and analytical tools such as Yahoo Finance or Morningstar to track market trends, read expert analyses, and monitor individual stocks’ performance.

Robo-advisors are automated platforms that create and manage a diversified portfolio based on your risk tolerance and goals. Examples include Betterment and Wealthfront. These services remove much of the emotional decision-making and complexity for beginners.

For example, an investor using the Robinhood app could set up a watchlist for stocks like Alphabet, Amazon, and Walmart, receive real-time price alerts, and execute trades within minutes. Using these tools smartly improves decision-making and helps avoid costly mistakes.

—

Future Perspectives in Stock Market Investing

The landscape of stock market investing continues to evolve, driven by technological innovation, regulatory changes, and shifts in global economies. Artificial intelligence (AI) and machine learning are increasingly influencing trading strategies, providing new insights and predictive analytics that were previously unavailable.

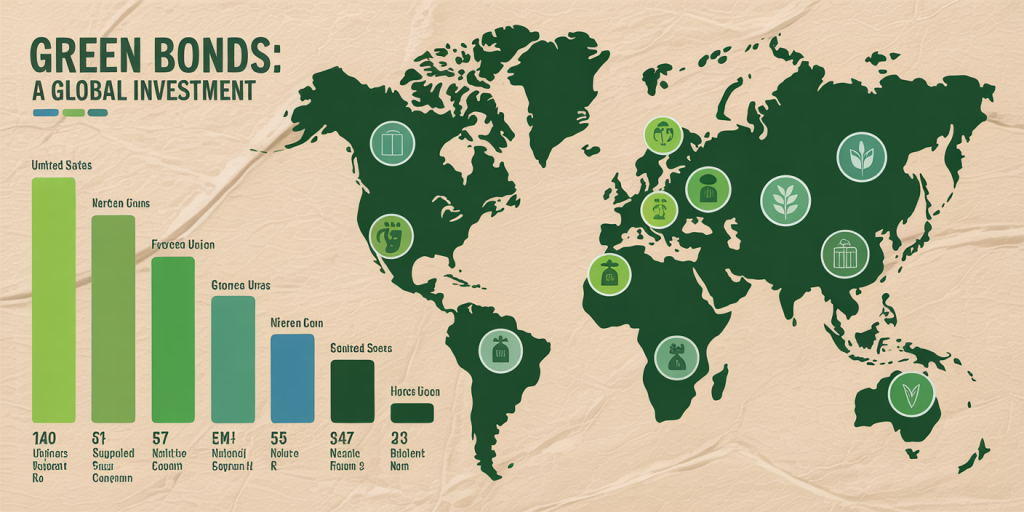

Environmental, Social, and Governance (ESG) investing is gaining momentum as investors prefer companies with sustainable business practices. According to a 2023 Global Sustainable Investment Review, ESG assets under management globally topped $40 trillion, highlighting a significant shift towards responsible investing.

Moreover, the rise of fractional shares enables investors with limited capital to own pieces of high-priced stocks, democratizing access to blue-chip companies.

The advent of decentralized finance (DeFi) and tokenized securities suggests future stock investing might integrate blockchain technology, potentially increasing transparency and reducing transaction costs.

For beginners, staying updated through continuous education and adapting to new tools and trends will be critical for long-term success. Keeping a disciplined investment approach while embracing innovation may unlock unprecedented opportunities in the years ahead.

—

References: Statista (2023). “Total Market Capitalization of World Stock Markets.” Retrieved June 2024. Global Sustainable Investment Alliance (2023). “Global Sustainable Investment Review.” Morningstar (2024). “Stock Market Fundamentals & Metrics.” Bloomberg (2024). “Technology in Stock Trading: AI and Future Trends.”

With this foundational knowledge and a strategic mindset, beginners can confidently navigate the stock market and establish portfolios aligned with their financial aspirations.