Securing funding is a pivotal milestone in the growth trajectory of any business. However, many entrepreneurs grapple with the dilemma of raising enough capital while retaining decision-making authority. Diluting ownership often translates to giving away control, which can alter the direction and culture of the company. The good news is that raising capital without losing control is achievable with the right approach, understanding of financial instruments, and strategic partnerships.

In today’s competitive market, startups and established companies alike need external funds to scale operations, invest in innovation, or enter new markets. According to a 2023 report by Crunchbase, startups raised over $335 billion globally, but nearly 40% of founders expressed concerns over relinquishing control to investors. This article explores various strategies for raising capital while maintaining governance, illustrated with practical examples and comparative insights.

—

Understanding the Trade-off Between Capital and Control

Raising capital typically involves exchanging ownership equity or debt. Equity investors usually demand shares of the company, which may lead to loss of control, depending on their voting rights and stake size. Debt financing, on the other hand, allows companies to retain full ownership but comes with repayment obligations and interest expenses.

For example, in the early stages of Airbnb, co-founders Brian Chesky and Joe Gebbia managed to raise $600,000 from Y Combinator without giving up significant control. The accelerator provided funding in exchange for a small equity stake, and the founders retained majority control during initial development phases. Contrast this with WeWork’s 2019 struggle, where raising large venture capital funds resulted in diluted founder control, eventually contributing to its failed IPO and a major shift in leadership.

This illustrates the fundamental trade-off in capital raising—equity funding often means sharing control, while debt preserves control but increases financial risk. Entrepreneurs need to evaluate their priorities and experiment with hybrid strategies to balance financial needs with governance preservation.

—

Alternative Financing Methods That Preserve Control

Revenue-Based Financing

Revenue-based financing (RBF) enables companies to raise capital in exchange for a percentage of future revenue rather than equity. This approach aligns investor returns with business performance without diluting ownership. Many SaaS companies use RBF to grow rapidly while maintaining control.

A practical example is Pipe, a fintech startup that has facilitated hundreds of millions in revenue-based financing for other firms. Companies can leverage their recurring revenue as collateral and repay investors when they gain revenue streams, avoiding traditional debt cycles. RBF is particularly attractive for companies with predictable cash flow but wary of equity dilution.

Convertible Notes and SAFE Agreements

Convertible notes and Simple Agreements for Future Equity (SAFE) instruments act as deferred equity rounds. They provide immediate funds without issuing shares upfront, allowing founders to postpone valuation and equity discussions until a later financing round. This delays control dilution and maintains founder consensus in early growth phases.

For instance, many Y Combinator startups utilize SAFE agreements during seed rounds. While investors have a promise for future equity, control stays with founders until conversion triggers, such as a priced round. This approach balances cash infusion needs and governance sovereignty, especially when valuation is uncertain.

—

Strategic Partnerships and Joint Ventures

Sometimes, raising capital through partnerships allows companies to infuse resources, expertise, and funding without heavily diluting control. Strategic partnerships often involve collaboration agreements with established companies interested in innovation and market expansion.

Tesla’s early relationships with Panasonic are a good example. Instead of solely pursuing equity investors, Tesla forged a partnership to secure battery technology and production funding. This alliance injected capital and resources while Tesla’s management retained control over broader strategic decisions.

Joint ventures, on the other hand, create a new entity jointly owned by partners. This setup confines dilution and decision-sharing to specific projects, letting the parent company remain autonomous in other areas. For example, Siemens established a joint venture with Atos to focus on digital transformation services in the industrial sector while maintaining independent operations elsewhere.

—

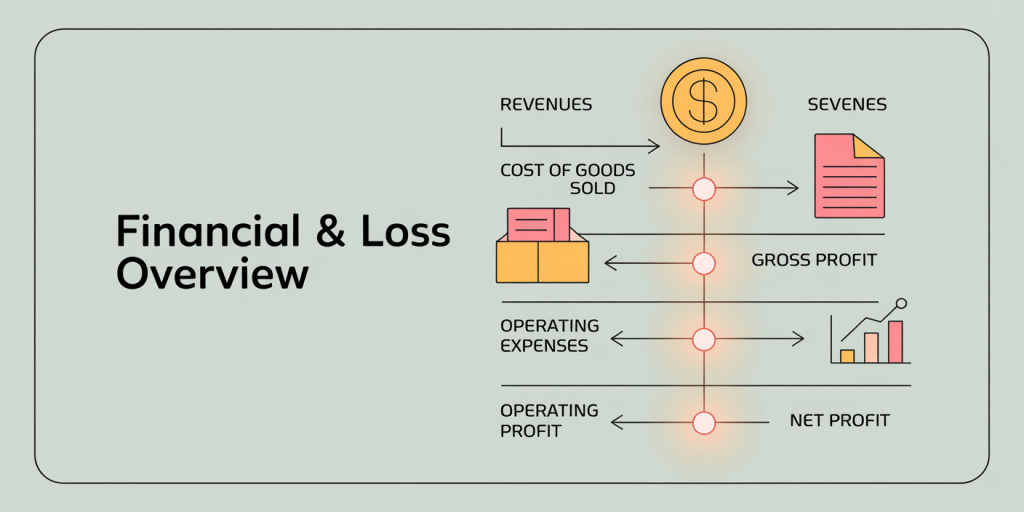

Leveraging Debt Financing Without Compromising Growth

Debt financing remains a potent tool for retaining full ownership. Bank loans, lines of credit, and asset-based lending provide capital injection without handing over equity. However, the risks include repayment strictness and interest burdens, which require careful cash flow management.

A noteworthy case is Uber, which raised over $7 billion primarily through debt instruments and convertible debt in its earlier rounds. This enabled the company to preserve founder and executive control while turbocharging expansion. Debt instruments often come with covenants limiting operational freedom, but when managed properly, they safeguard ownership stakes.

Companies considering debt should evaluate lending rates and terms rigorously. According to the Federal Reserve’s 2024 Small Business Credit Survey, 69% of small businesses that successfully obtained loans reported improved financial outcomes without sacrificing management autonomy.

—

Comparing Funding Options: Equity vs. Debt vs. Alternative Capital

The table below highlights critical factors entrepreneurs should consider when selecting a funding route to raise capital without relinquishing control:

| Funding Type | Impact on Control | Financial Risk | Flexibility | Typical Suitability |

|---|---|---|---|---|

| Equity Financing | Moderate to high dilution | Low (no repayments) | Shares voting rights | Early-stage, high-growth startups |

| Debt Financing | No equity dilution | Moderate to high | Fixed repayment | Established businesses with cash flow |

| Revenue-Based Financing | No dilution | Moderate (linked to revenue) | Flexible repayment | Recurring revenue businesses |

| Convertible Notes/SAFE | Deferred dilution | Low until conversion | Flexible timing | Seed-stage with uncertain valuation |

| Strategic Partnerships | Partial (project-specific) | Variable | Collaborative | Companies seeking synergy, tech access |

This comparative overview equips entrepreneurs with practical insights on how to tailor their capital raising strategies aligned to control preferences and business stage.

—

Real-World Strategies for Maintaining Control

Maintaining control while raising capital requires proactive negotiation and structuring. Terms such as voting agreement rights, board composition, protective provisions, and founder-friendly clauses can safeguard decision-making authority.

For example, Snapchat’s co-founders structured their 2013 funding rounds to retain super-voting shares, enabling them to hold majority voting power despite minority equity ownership. This dual-class share structure is a common method among tech giants like Google and Facebook.

Additionally, phased funding can maintain control incrementally. Startups may raise small rounds initially to validate growth before larger rounds that potentially dilute control are accepted. Companies like Zoom started with minimal seed capital, building a strong revenue foundation before taking larger investments.

—

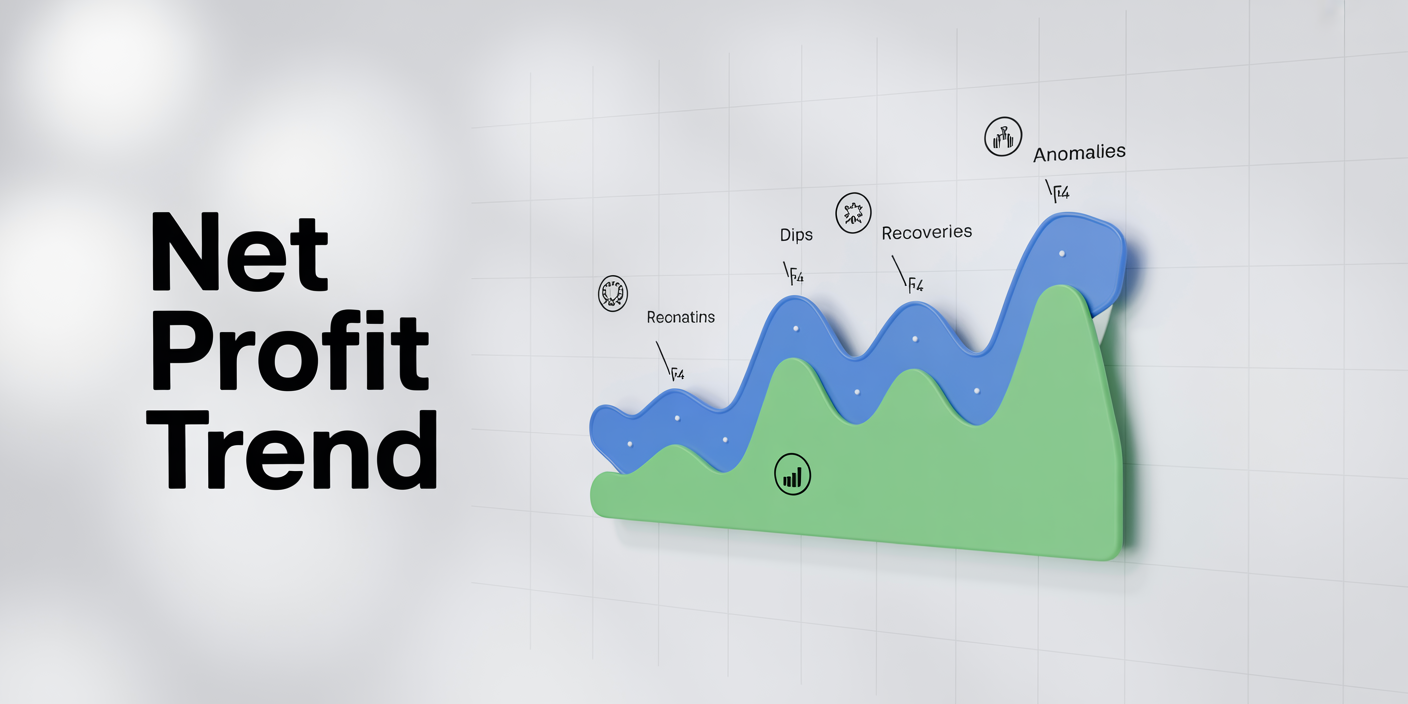

Looking Ahead: Future Trends in Capital Raising and Control

The landscape of capital raising is evolving with fintech innovations and new financial instruments that better align founders’ desires to retain control. Tokenization and decentralized finance (DeFi) platforms are creating new avenues for raising non-dilutive capital by leveraging asset-backed tokens or revenue-sharing smart contracts.

According to PwC’s 2024 Global Crypto Report, 28% of startups are exploring tokenized fundraising methods that bypass traditional equity dilution. These innovations might redefine how startups raise capital with greater transparency, liquidity, and control retention.

Moreover, impact investing is gaining traction. Investors focusing on social and environmental goals often tolerate less control in exchange for mission alignment. This can result in funding agreements emphasizing operational autonomy for founders committed to purpose-driven growth.

As regulatory frameworks adapt, entrepreneurs will have more tools to customize capital raising, balancing control with financial needs. Hybrid models combining traditional equity, debt, and emerging instruments will become commonplace, allowing greater flexibility for founders.

—

Raising capital without losing control is no longer a binary choice. With diverse financing options, strategic structuring, and emerging financial technologies, entrepreneurs can grow sustainably while safeguarding their vision and governance. Choosing the right combination based on business needs, market conditions, and founder priorities is critical in navigating this complex but rewarding journey.